Bitcoin: 2016 in Review

In addition to my day job as a BitGo engineer, I run Statoshi.info, a site I created in 2014 to track Bitcoin metrics from the perspective of a full node.

I’ve always been fascinated with the raw numbers relating to the status and growth of Bitcoin, especially as the hype cycle is turned up or down, depending on popular sentiment. To that end I’ve compiled statistical measurements of Bitcoin’s growth in 2016 from a variety of sources.

Before we dive into the metrics, one thing is clear: Bitcoin is at the center of an increasingly complex ecosystem that continues to grow in a variety of ways. It is difficult to see all of the moving pieces since statistics are spread across many sources, but the picture becomes more clear when you bring them all together.

General Interest Statistics

Academic interest continues to rise. Note that Google Scholar stats usually lag by several months, thus we expect the 2016 number will continue rising:

Google Scholar articles published mentioning Bitcoin:

— Jameson Lopp (@lopp) December 17, 2016

2009: 83

2010: 136

2011: 218

2012: 424

2013: 1,390

2014: 3,190

2015: 3,670

2016: 3,580

Willy Woo graphed some academic paper stats:

#bitcoin citations vs bitcoin mentions vs #blockchain mentions in academic papers. Twitter Source: @lopp pic.twitter.com/La3Vj08ouN

— Willy Woo (@woonomic) December 17, 2016

Search interest was once again on the rise:

Google Trends data for "buy bitcoin": December 2016 ends @ 57% of ATH ... looks to be ramping up pic.twitter.com/z3SCHVJKXz

— Alistair Milne (@alistairmilne) January 1, 2017

Bitcoin was proclaimed dead another 28 times:

Deaths of Bitcoin proclaimed per year:

— Jameson Lopp (@lopp) December 17, 2016

2010: 1

2011: 6

2012: 1

2013: 14

2014: 27

2015: 40

2016: 28https://t.co/qagl2fbtpq

Mining Statistics

Hash rate tripled (technically it increased 200%, not 300%):

Bitcoin's hash rate has increased 300% from 743,000,000 GH/s to over 2,220,000,000 GH/S this year. pic.twitter.com/eowEQl7HJm

— Jameson Lopp (@lopp) December 17, 2016

Hash rate accelerated at the fastest rate ever. This is equivalent to adding a 14 TH/S Antminer S9 every 4.5 minutes:

Bitcoin's network security accelerated at an average rate of 52 GH/s^2 in 2016. https://t.co/4vfgik29me

— Jameson Lopp (@lopp) December 20, 2016

Hash power become more decentralized:

Bitcoin mining hash power became more decentralized in 2016, according to @oocBlog's measurements. pic.twitter.com/x1GyAlwShr

— Jameson Lopp (@lopp) December 21, 2016

The worst case attack scenario for an entity to brute force rewriting the entire history of Bitcoin’s blockchain dipped quite low but then shot back up. This is a unique measure of Bitcoin’s network security:

The days of work a miner w/100% of current hashpower would need to rewrite entire blockchain rose to 290 from a low of 180 earlier this year pic.twitter.com/VEKiX8LqJb

— Jameson Lopp (@lopp) December 17, 2016

Miner revenue surged:

Unsurprisingly, as per-transaction fee rates rose this year, so did total fee revenue collected by bitcoin miners. https://t.co/KvwsHfxe5x pic.twitter.com/F5zTfFaQwj

— Jameson Lopp (@lopp) December 17, 2016

Transaction Statistics

Average transactions per second increased about 50%

Bitcoin transactions per second crept up throughout 2016 from ~2 TX/S to ~3.3 TX/S https://t.co/HwwstDYz7y pic.twitter.com/O0HXHVDUDg

— Jameson Lopp (@lopp) December 17, 2016

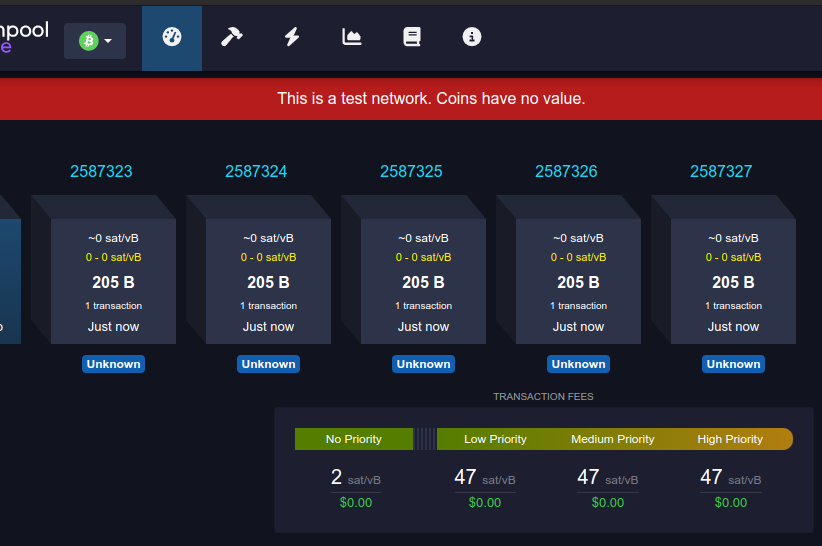

As contention for limited block space increased, the usage of dynamic transaction fees surged:

Usage of dynamically calculated bitcoin transaction fees has increased from ~20% to ~70% this year. https://t.co/i6RHc60GRD pic.twitter.com/3j26djlQd2

— Jameson Lopp (@lopp) December 17, 2016

Transaction fee estimates also surged as users vied to outbid each other:

Bitcoin Core's txn fee rate estimate to get confirmed in next 3 blocks rose 557% from 14 to 78 satoshis/byte. That's 1,013% in USD terms. pic.twitter.com/2kN71hH2Cl

— Jameson Lopp (@lopp) December 17, 2016

Transaction fees relative to block subsidy rose, offering some hope that Bitcoin will continue to be able to pay for its own security as the block rewards decrease in the coming years:

Bitcoin tx fees relative to block subsidy increased from 1% to over 5%, helped by the subsidy halving. https://t.co/OA3oIhHeIj pic.twitter.com/HvUzPpthIJ

— Jameson Lopp (@lopp) December 17, 2016

Median time to confirm rose, pointing once again to demand for block space exceeding available supply:

Median bitcoin transaction confirmation time is on the rise this year, from ~7 minutes to over 10 minutes. https://t.co/eiyRMaAtIi pic.twitter.com/n6ZEp8OQ2G

— Jameson Lopp (@lopp) December 17, 2016

The size of the unspent transaction outputs set increased, suggesting that there are probably more unique entities owning bitcoins:

Total # of UTXOs has increased 30% this year to 43.5M

— Jameson Lopp (@lopp) December 17, 2016

Size of serialized UTXO set increased 50% to 1.5GBhttps://t.co/7Nn2EZ34MG pic.twitter.com/ul2Xnnuu2h

In fact, we created a net new UTXO every 3 seconds:

Bitcoin's UTXO set increased 30% in 2016 to 44M outputs, adding a net additional output every 3 seconds. https://t.co/weVY2tmAgn

— Jameson Lopp (@lopp) December 20, 2016

Network Statistics

Reachable node count held steady after falling for the past several years:

Reachable Bitcoin node count held steady in 2016; nodes reachable via TOR more than doubled. https://t.co/n8bs3YSk1E pic.twitter.com/eIkfLD3dDp

— Jameson Lopp (@lopp) December 17, 2016

Block propagation times halved:

Median block propagation times steadily decreased by 50% throughout 2016, down to ~2 seconds. https://t.co/n8bs3YSk1E pic.twitter.com/0xDV2mRQSD

— Jameson Lopp (@lopp) December 17, 2016

OP_RETURN outputs increased 60% year-over-year due to a rise in popularity of anchoring services such as Blockstack, Colu, and Counterparty:

Bitcoin OP_RETURN outputs created in:

— Jameson Lopp (@lopp) December 19, 2016

2014: 13,000

2015: 655,000

2016: 1,040,000https://t.co/OjcRqhtD7i

Percentage of full blocks increased throughout the year:

A downtrend in Bitcoin blocks that didn't utilize their maximum capacity continued throughout 2016. https://t.co/xBgxwK5Xua pic.twitter.com/nru8UjpigQ

— Jameson Lopp (@lopp) December 19, 2016

The total size of Bitcoin’s blockchain doubled:

The size of bitcoin's blockchain doubled in 2016 to 100GB https://t.co/b9husA3mMq

— Jameson Lopp (@lopp) December 20, 2016

Development Statistics

Activity on the dev email list went back to “normal” levels:

Activity on the Bitcoin Development mailing list remained low in 2016 compared to the surge of block size debate threads in 2015. pic.twitter.com/hm7OmRv1eM

— Jameson Lopp (@lopp) December 18, 2016

IRC activity moved over to the core dev room:

An exodus of activity out of the bitcoin-dev IRC room and into the bitcoin-core-dev IRC room occurred in 2016. pic.twitter.com/vsWJTKAO2C

— Jameson Lopp (@lopp) December 18, 2016

Bitcoin Core had a fair amount of Github activity:

#Bitcoin Core 2016

— Jonas Schnelli (@_jonasschnelli_) January 9, 2017

517 Github contributors

47 Git contributors

1’637 commits ~4.5/day

1’563 PRs created

15’208 Github comments ~41/day

You can see an excellent visualization of Core’s github activity here:

Economic Statistics

VC funding fell back to 2014 levels:

Blockchain industry venture capital funding:

— Jameson Lopp (@lopp) December 19, 2016

2012: $2.13M

2013: $95.05M

2014: $361.53M

2015: $490.48M

2016: $393.00Mhttps://t.co/s2SSO4Umx2

More Bitcoin payments were processed than ever before:

#Bitcoin's #blockchain transacted $115,000 USD per minute in 2016 = growth of 118%, per @GDAX & @ARKinvest research: https://t.co/xBm4ymLIoa pic.twitter.com/ftWOgwDUjd

— Chris Burniske (@cburniske) January 7, 2017

Bitcoin was once again the world’s best performing currency:

Bitcoin was the best-performing currency of 2016, and it looks like it still has room to run. Here's why https://t.co/feUkmc6p4M #BTECH pic.twitter.com/AeICsuMLDL

— Bloomberg TV (@BloombergTV) January 3, 2017

With an exchange rate increase of 123%, Bitcoin’s “market cap” increased past $16B, earning it 69th place globally in terms of M1 money supply.

All in all, 2016 was a good year for the Bitcoin ecosystem. We’re looking forward to seeing more growth in 2017!