Bitcoin 2021 Annual Review

I’ve always been fascinated with the raw numbers relating to the operational status and growth of Bitcoin, especially as we ride the rollercoaster of the adoption life cycle. This interest spurred me to create Statoshi.info in 2014 to track bitcoin metrics from the perspective of a full node.

To that same end, I’ve compiled statistical measurements of Bitcoin’s growth in 2021 from a variety of sources. It is difficult to see all of the moving pieces since the data is so distributed, but the picture becomes clearer when you bring them all together.

The one theme that I've taken away from all of these metrics is that 2021 was a growth year for Bitcoin, though it was unlike previous cycles of retail hype and we persevered through some significant hiccoughs.

Bitcoin is at the forefront of an increasingly complex ecosystem that continues to grow in a variety of ways. And for the 13th straight year, it stubbornly refused to die!

Bitcoin Obituaries:

— Jameson Lopp (@lopp) December 25, 2021

2010: 1

2011: 6

2012: 1

2013: 17

2014: 29

2015: 39

2016: 28

2017: 124

2018: 93

2019: 41

2020: 14

2021: 43https://t.co/K8Gna8iA4D

General Interest

El Salvador surged from 150th to 1st place with regard to relative search interest for Bitcoin.

Countries with the highest relative search interest for Bitcoin have changed significantly from 2020 to 2021! While it's no surprise to see El Salvador at #1, it's notable that it wasn't even on the list of 66 countries for which Google logged search interest in 2020. pic.twitter.com/i6fHQYUfh6

— Jameson Lopp (@lopp) December 25, 2021

General interest in educational resources remained low. This leads me to believe that recent growth in the exchange rate is spurred by a smaller number of high value investors rather than a flood of retail FOMO.

During 2021 an average of 563 visitors per day viewed my educational resources at https://t.co/8ZsrcEwSfa - a 109% increase over 2020. pic.twitter.com/4x2OMo5lmp

— Jameson Lopp (@lopp) December 25, 2021

Unlike my web traffic, Twitter chatter experienced high volume growth.

There were 101,000,000 tweets containing the word "bitcoin" in 2021 - 350% the volume of 2020. H/T @wullon pic.twitter.com/c9NhwWQCbH

— Jameson Lopp (@lopp) December 26, 2021

The bitcoin subreddit saw hockey stick growth. Comments and posts per day also more than doubled.

/r/bitcoin had a massive 2021, nearly doubling its subscriber count to a total of 3,706,000. By doing so it has finally broken into the top 100 subreddits in terms of subscribers! pic.twitter.com/mQmp6VMLzc

— Jameson Lopp (@lopp) December 25, 2021

I myself abandoned BitcoinTalk many years ago because I felt it was hard to find signal through the noise. It looks like user growth on that site continues to be modest.

BitcoinTalk total registered users:

— Jameson Lopp (@lopp) December 25, 2021

2009: 19

2010: 3,127

2011: 48,827

2012: 76,680

2013: 207,357

2014: 406,833

2015: 710,256

2016: 935,550

2017: 1,346,000

2018: 2,464,000

2019: 2,718,000

2020: 2,916,000

2021: 3,412,000

Academic Interest

Academic interest continued to increase, which is great for the long-term prospects of this industry as we continue to gain a greater understanding of what we’re building.

Google Scholar articles published mentioning Bitcoin:

— Jameson Lopp (@lopp) December 25, 2021

2009: 83

2010: 136

2011: 218

2012: 424

2013: 868

2014: 2,070

2015: 2,820

2016: 3,380

2017: 6,460

2018: 11,500

2019: 20,300

2020: 24,000

2021: 21,500 (will ⬆️ due to listing lag)

Cryptology ePrint Archive papers mentioning Bitcoin:

— Jameson Lopp (@lopp) December 25, 2021

2011: 1

2012: 3

2013: 8

2014: 18

2015: 20

2016: 26

2017: 24

2018: 26

2019: 20

2020: 24

2021: 24

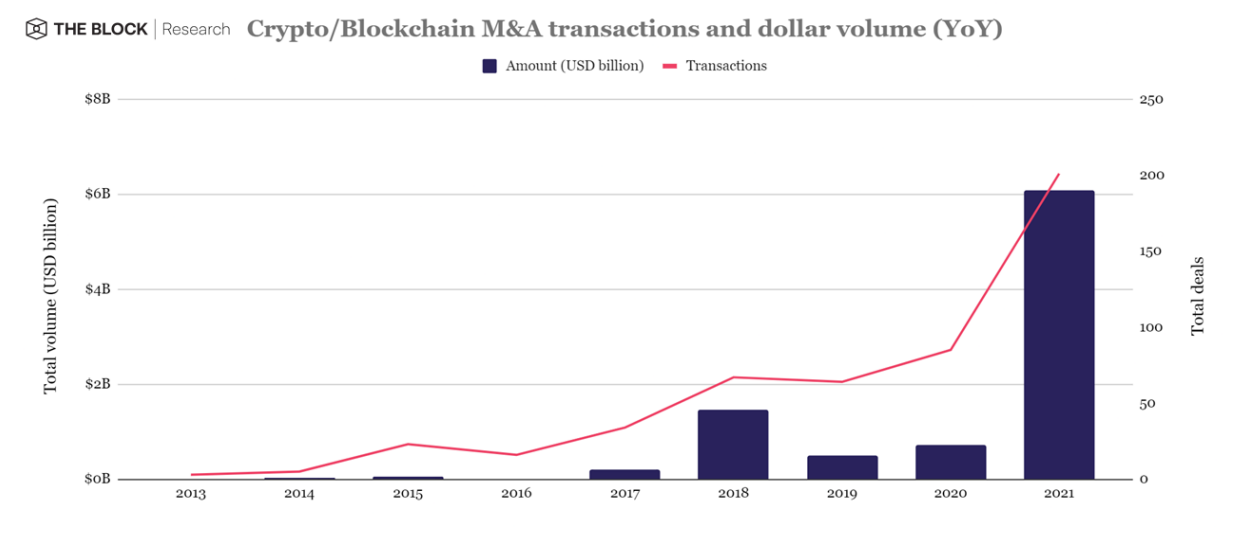

Funding and Forking

Venture capital funding is exploding as the companies that survived previous cycles are now orders of magnitude larger and raising huge late stage rounds of funding.

Crypto industry venture capital funding:

— Jameson Lopp (@lopp) December 27, 2021

2012: $23M

2013: $120M

2014: $368M

2015: $850M

2016: $850M

2017: $1,200M

2018: $6,000M

2019: $3,000M

2020: $3,500M

2021: $25,000M

2021 was certainly a more volatile year in both directions with regard to exchange rate. The net change year over year was much smaller than 2020, yet we went up and down far more times.

Bitcoin's 30 & 60 day exchange rate volatility averaged around 4% during 2021, over 1% higher than the previous year. pic.twitter.com/ZayWQV27H6

— Jameson Lopp (@lopp) December 27, 2021

2021 saw a surge in layer 1 competitors to Ethereum, with several networks surging in value as they offer faster and cheaper alternatives with the same functionality. This resulted in the overall crypto market cap surging and made Bitcoin's share smaller.

Bitcoin market cap dominance (a highly manipulable metric of questionable value) dropped throughout 2021 despite the increase in exchange rate, as a number of new tokens reached unicorn status. pic.twitter.com/qVGOf4iyJW

— Jameson Lopp (@lopp) December 29, 2021

On the other hand, the "fast, cheap payments" narrative has not played out well for BCH and BSV. This is a highly competitive arena in which dozens if not hundreds of altcoins can claim to be "the best." And of course, Bitcoin itself continues to compete in this space via Lightning Network, which we'll cover later.

Forkcoiners had a moment of hope in May but will end the year down double digit percentages against BTC. pic.twitter.com/PHb0bEctCf

— Jameson Lopp (@lopp) December 29, 2021

On-Chain Transactions

While development of Lightning Network made more progress in 2021, due to its stronger privacy features we’ll always have more accurate statistics of on-chain activity.

Bitcoin's daily adjusted on-chain value transferred hit $36B in 2021. For context, the previous peak was $9B in December 2017. pic.twitter.com/pO5xxtUsPK

— Jameson Lopp (@lopp) December 29, 2021

A more controversial aspect of the changing nature of bitcoin is the transaction fees. Rising fees caused significant frustration for users trying to transact in smaller amounts of value during late 2017 and early 2018, but fees were nearly 0 for the following 2 years due to a variety of factors. Lower transaction demand, improved fee estimation algorithms, adoption of segregated witness, transaction batching, and lightning network resulted in more efficient use of block space and less contention for this scarce resource. In 2020 we saw demand increase and fees followed suit, but then both demand and fees fell to the floor.

Some will point to Blockchain wallet finally implementing SegWit as the reason for this. It certainly played a role, though block space demand also dropped for other reasons around the same time. One, because of the price drop and retail interest also decreasing. Another plausible explanation I've heard is that the rise in popularity of stablecoins means that traders now have other options to send money to "crypto only" exchanges and thus don't have to use bitcoin as a payment rail. That means more of the transfer volume has migrated to the networks on which those stablecoins are being used.

Revenue collected via transaction fees by bitcoin miners nearly reached all-time highs in April before spending the latter half of the year averaging under $1M per day. pic.twitter.com/n01pQiUEO9

— Jameson Lopp (@lopp) December 30, 2021

The fee market for Bitcoin block space dropped off a cliff mid-year. pic.twitter.com/amfdpdsf1C

— Jameson Lopp (@lopp) December 30, 2021

Despite the drop-off in transaction fees and reward halving in 2019, Bitcoin miners are doing quite well thanks to the increasing exchange rate.

Bitcoin miners have earned nearly $38 billion over the past 13 years and revenue is accelerating. This number assumes they instantly sell for fiat, which is most certainly not the case - miners are HODLers. pic.twitter.com/woFgxU3mXD

— Jameson Lopp (@lopp) December 30, 2021

Address reuse likely had a floor set on it due to the security mechanisms at exchanges. Some estimates have put nearly half of all bitcoin transactions as being exchange-related, and the deposit/withdrawal mechanisms of exchanges tend to encourage not generating new addresses.

Bitcoin address reuse, which is a poor privacy practice, started trending back upward in 2021 after several years of decreasing. Half of all addresses that receive funds today are being reused. pic.twitter.com/pOOtSN7VFo

— Jameson Lopp (@lopp) December 30, 2021

SegWit adoption is reaching saturation; I expect it will take many years for us to asymptotically approach 100% adoption.

Thanks to the Blockchain wallet finally rolling out SegWit support in June, the percentage of SegWit spending transactions started grinding through continual all time highs. As of today, 82% of Bitcoin transactions spend SegWit inputs. pic.twitter.com/u4yXZwbpa9

— Jameson Lopp (@lopp) December 30, 2021

UTXO set growth continued its growth trend from 2020, though you can once again see muted interest after the mid-year exchange rate slump.

Bitcoin's UTXO set rose from 68M to an all-time high of 78M in 2021, adding a net new UTXO every 3 seconds. pic.twitter.com/LGOQ8wk2Ny

— Jameson Lopp (@lopp) December 30, 2021

Bitcoin Data Anchoring

While you may think of bitcoin as being a cryptocurrency, some users think of it as a trust anchor. By embedding data into Bitcoin’s blockchain, other systems can gain new properties such as tamper evidence and immutability.

The amount of outputs that embedded data into the blockchain increased at an unprecedented rate in 2019, mostly due to Veriblock's "proof of proof" mining coming online. However, since then we seem to be making a return to normal based upon what uses cases are economically justifiable. OP_RETURN creation dropped by 72% in 2020 and then by another 63% in 2021.

Bitcoin OP_RETURN (data anchor) outputs created in:

— Jameson Lopp (@lopp) December 29, 2021

2014: 13,000

2015: 655,000

2016: 1,040,000

2017: 2,253,000

2018: 6,750,000

2019: 28,200,000

2020: 7,830,000

2021: 2,970,000

But OP_RETURN isn’t the only way to anchor other systems onto Bitcoin’s blockchain. Sidechains use pegging mechanisms to cryptographically lock BTC on the main chain and then allow users to unlock a proportional amount of tokens on a sidechain. This allows for experimentation with other features that are unlikely to be added to the Bitcoin protocol. At time of writing the only two production sidechains are RSK and Liquid. Work continues to progress on drivechains, though it's hard to say if and when we'll see drivechains in production use.

The Bitcoin hashpower that is merge mining the @RSKsmart sidechain is holding steady in the 55% - 60% range https://t.co/RWKM5GdG3b

— Jameson Lopp (@lopp) December 30, 2021

The amount of BTC pegged into rootstock increased from 546 to 2,520 during 2021 https://t.co/MgPzrAgw2P

During 2021 the amount of BTC pegged into @Blockstream's Liquid network increased 29% to 3,354. pic.twitter.com/wmIxRw1f3Z

— Jameson Lopp (@lopp) December 31, 2021

Lightning Network

The observable network grew significantly in 2021. It's also becoming more difficult to know how accurate the metrics are for Lightning Network as more channels are being created privately.

Lightning Network in 2021:

— Jameson Lopp (@lopp) December 31, 2021

# advertised channels ⬆️ 124% to 84,377

# nodes with channels ⬆️ 132% to 1,948

Bitcoin in those channels ⬆️ 212% to 3,309 BTC

Network total USD value ⬆️ 410% to $158M

NOTE: unadvertised channels and their value can't be measured.

Small typo in the above node count metric; it's actually 19,048.

Lightning Network density is now below 0.1% - you can think of this as an inverse efficiency metric. A 100% dense network would be one in which every node connects to every other node, which would tie up a ton of capital and other resources. pic.twitter.com/nX4pQZ1EGl

— Jameson Lopp (@lopp) January 2, 2022

https://t.co/9TviYagVWi Lightning Network Revenues:

— Alex Bosworth (@alexbosworth) December 31, 2021

2018: 0.1184 BTC

2019: 0.2194 BTC

2020: 0.3477 BTC

2021: 1.0800 BTC

My total capital and coding involved has stayed fairly flat over this time. Routing has grown a lot.

Chain fee costs declined dramatically from 2020 levels.

DeFi

2021 was a big year for folks building financial infrastructure on Ethereum and Bitcoin wasn't left out. While many like to point out that there is "more bitcoin on Ethereum than Lightning Network" these figures are hardly comparable because the security models are completely different.

Wrapped bitcoin increased by 133% in 2021 to 329,000 BTC across different protocols. pic.twitter.com/mmHkLbvGhC

— Jameson Lopp (@lopp) December 31, 2021

The vast majority of wrapped bitcoin are in fact custodied by BitGo for their WBTC token, so I think of this metric as more akin to a "balances on exchanges" metric.

Network Security and Health

The number of Bitcoin nodes is back on the rise - I attribute this to more user friendly "plug and play" node projects gaining popularity.

Reachable Bitcoin node count increased 30% in 2021 according to @port8333. The fascinating thing is that this is a result of a surge in tor nodes - the number of nodes reachable via IPV4 actually decreased. pic.twitter.com/LgDi8Y0fXR

— Jameson Lopp (@lopp) January 2, 2022

The number of unreachable nodes (behind routers without port forwarding) was also fairly steady around 50,000. This is probably evidence of a node floor of dedicated Bitcoiners who have persevered through the bear market. I fully expect this number to be an indicator of retail FOMO and that it will shoot up if a bunch of newbies enter the space. So you might be confused by this next chart that shows a lot of volatility. It turns out that this was due to a bunch of fake nodes that skewed the metrics until Luke-Jr adjusted his algorithm to filter them out.

According to @LukeDashjr's estimates of unreachable / non-listening node counts, the total number of Bitcoin nodes surged 80% to 90,000 in 2021 before completely retracing. pic.twitter.com/areJulXFjw

— Jameson Lopp (@lopp) January 2, 2022

A variety of improvements in block propagation have been implemented by Bitcoin Core over the past several years; network propagation performance has been fairly consistent since 2019.

Bitcoin block propagation times varied throughout 2021 but ended up with an average of 948 milliseconds for a block to reach half of the nodes on the network. pic.twitter.com/sAj064OmlT

— Jameson Lopp (@lopp) January 2, 2022

Bitcoin transaction propagation slowed down from 2.5 to 5 seconds in 2021. My initial guess is that this may be a result of the surge in tor nodes increasing relay latency. pic.twitter.com/jVKJ2GBti1

— Jameson Lopp (@lopp) January 2, 2022

In last year's review I noted that I believed that we were seeing a lag in hashrate increase due to a supply shortage of ASICs. I expected 2021 to see a major uptick in hashrate as more machines came online. The China mining ban certainly put a kink in that prediction, though we still managed to accelerate hashrate and based upon all the investments we're seeing by industrial miners in North America, I do expect 2022 to be bonkers.

Bitcoin's network hashrate increased by 10% during 2021, from 159 to 175 exahash per second.

— Jameson Lopp (@lopp) January 2, 2022

But that's not noteworthy. Weathering and completely recovering from a 50%+ drop due to a mining ban by the country with the most hashpower was a major milestone for network resilience. pic.twitter.com/yw8HwXm9pG

The proof-of-work equivalent days is an interesting metric though it should not be construed as a reasonable attack that we should be worried about. Theoretically an attacker could have 1,000% of the total network hashrate or more and perform various block reorganization and double spending attacks. Practically, of course, there are physical limitations to acquiring that level of hardware and electricity.

BITCOIN POW EQUIVALENT DAYS HITS ALL TIME HIGH!

— Jameson Lopp (@lopp) January 2, 2022

An attacker with 100% of the current hashrate would have to spend over 2 years mining in order to accumulate enough work to rewrite the entire bitcoin blockchain. pic.twitter.com/4bY9ldlR8H

This is the first year since I've started tracking annual network hashrate growth that we nearly failed to accelerate faster than the previous year. Of course that's 100% a result of the Chinese mining ban wreaking havoc on the hashrate. We are still accelerating of course, and I expect that 2022 will accelerate growth even faster as we are seeing major investments in infrastructure as folks seek out cheap stranded and renewable energy across the world. Volcano mining, anyone?

Bitcoin's thermodynamic security accelerated at an average rate of 1,507 GH/s^2 in 2021. https://t.co/8CeTh67kpO

— Jameson Lopp (@lopp) January 1, 2022

In terms of general ecosystem security, 2021 was an amazing year! Major hacks cause loss in confidence in the system and can serve as major setbacks even though they have nothing to do with the protocol or network security.

As far as I can tell, only 6,071 BTC was stolen in major publicly announced thefts during 2021. This amounts to 0.03% of the total supply.

— Jameson Lopp (@lopp) January 2, 2022

Caveats: we don't have numbers for the 6K Coinbase users affected by SMS resets & I assume claims of Africrypt having 69K BTC are false.

Physical attacks tend to be correlated with the exchange rate; we saw a doubling of both in 2021.

Known Bitcoin related physical attacks in

— Jameson Lopp (@lopp) December 29, 2021

2014: 1

2015: 5

2016: 4

2017: 12

2018: 25

2019: 8

2020: 11

2021: 25

Cost of Node Operation

Anyone who has been following the Bitcoin space for long is likely aware of the scaling debate that resulted in a variety of both software forks and blockchain forks. The good news for node operators is that it appears the resources required to fully validate the entire history of the blockchain are decelerating, meaning that node operators should be able to take advantage of the deflationary nature of technology.

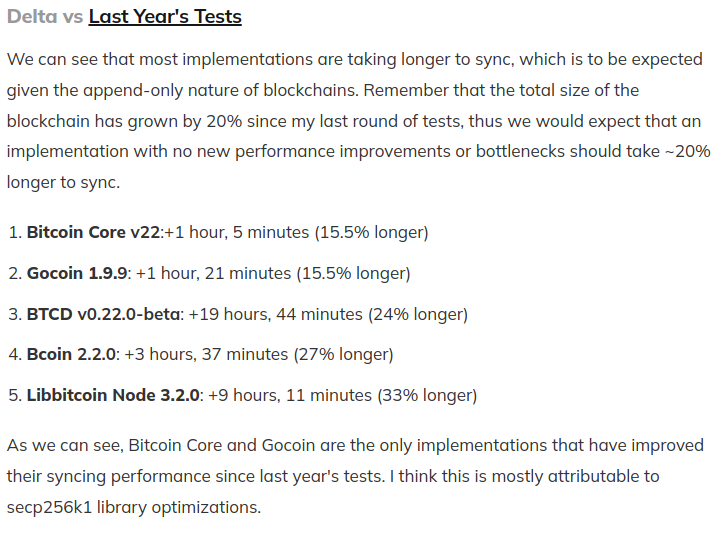

I ran performance tests of every Bitcoin client and sync performance only improved for 2 of the 5 clients.

In terms of total storage required, the annual blockchain growth rate is now down to 20%, which ought to be easily addressed by increasing hard drive density. And of course you can always run a pruned node (though it will still have to download all of the data during the initial sync) that only needs 10 GB or so.

During 2021 the Bitcoin blockchain grew from 319GB to 383GB - an annual growth rate of 20%. pic.twitter.com/mLK9WjAWSg

— Jameson Lopp (@lopp) January 1, 2022

Bitcoin Economics

As usual, many of Bitcoin's economic metrics were correlated to the exchange rate, which spent the year bouncing back and forth, breaking all-time highs in the process.

Median bitcoin transaction value spent 2021 bouncing between $30K and $70k, both being all time highs that were never before seen historically. pic.twitter.com/pbn2HWHXE3

— Jameson Lopp (@lopp) January 3, 2022

To show how heuristics can vary widely: @coinmetrics estimates (by removing likely change outputs) that $4.67T was transferred via bitcoin in 2021, averaging $148,000 per second. pic.twitter.com/55wYXorh1I

— Jameson Lopp (@lopp) January 3, 2022

From a relative historical standpoint, the overall change in exchange rate was average.

Bitcoin average DAILY value change during:

— Jameson Lopp (@lopp) January 1, 2022

2010: +0.82%

2011: +0.76%

2012: +0.26%

2013: +1.11%

2014: -0.25%

2015: +0.09%

2016: +0.22%

2017: +0.78%

2018: -0.33%

2019: +0.18%

2020: +0.38%

2021: +0.12%

To calculate the above, use the formula:

Jan 1 exchange rate * (x³⁶⁵)=Dec 31 exchange rate

Bitcoin Trading

ATM growth continues to hockey stick, though I question whether ATM usage is following suit given that on-chain metrics don't indicate the same level of retail usage. I'm assuming that most ATMs don't yet support Lightning Network, which would hide that form of adoption from the on-chain metrics.

The number of deployed Bitcoin ATMs increased by 142% during 2021 to over 33,850. pic.twitter.com/DJxG80TPOl

— Jameson Lopp (@lopp) December 28, 2021

Crypto exchange trading volumes have blown away previous historical records throughout 2021. pic.twitter.com/JofWgUXrD8

— Jameson Lopp (@lopp) December 27, 2021

Bitcoin balances on exchanges ended 2021 higher at 1.56M BTC according to @coinmetrics, but they ended the year lower at 2.55M BTC according to @glassnode. 🤷♂️ pic.twitter.com/kLs24CZKG6

— Jameson Lopp (@lopp) January 3, 2022

Technical Development

At a protocol level, there was a great deal of work done in 2021 with the Taproot activation and more Lightning improvements. If you want a deep dive into low level developments I recommend reading Bitcoin Optech's year-in-review.

The Bitcoin Core repository continues to maintain its dominance as the most active.

2021 commits (excluding merges) & contributors:

— Jameson Lopp (@lopp) January 3, 2022

bitcoin core: 3,417 & 184

c-lightning: 1,612 & 42

lnd: 1,338 & 73

rust-lightning: 1,018 & 22

eclair: 277 & 12

blockcore: 83 & 15

btcd: 158 & 29

gocoin: 318 & 1

bcoin: 35 & 5

libbitcoin-system: 89 & 4

Source: calculated from the default development git branch of each repo.

git shortlog --after 2021-01-01 --summary --numbered --no-merges

Here you can visualize the year's activity in the Bitcoin Core code repository:

Conclusion

Most people are only familiar with the exchange rate of Bitcoin, if that. But exchange rate is just one of many metrics we can use to observe the evolution of this ecosystem. While any given metric can be gamed or may be taken from sources that aren’t 100% reliable, by using a diversity of metrics and sources we can get a rough idea of the trends in this space.

2021 was a unique cycle that I believe can mostly be attributed to big institutional players driving the market. Those of us who are dedicated to this system shall continue to BUIDL and add value; we have no control over the market but I expect that this is only the beginning of the next wave of adoption by the masses.

“Every day that goes by and Bitcoin hasn’t collapsed due to legal or technical problems, that brings new information to the market. It increases the chances of Bitcoin’s eventual success and justifies a higher price.” - Hal Finney