Ensuring Your Second Life with Bitcoin

A lot of Bitcoin holders tend to be early adopters of new technology; cryonics is a field of technology that is much older than Bitcoin and yet has far less adoption due to the high cost and low probability of success. As such, there is some natural overlap between adopters of both technologies.

If you're reading this, I assume you already have a decent understanding of Bitcoin. If you don't, bookmark bitcoin.page to begin your journey down the rabbit hole. But what about cryonics - does it make sense to freeze your body in the hopes that future medical technology can revive you? There's a great (lengthy) intro explanation here:

If you want to do a deep dive, Ralph Merkle is on the board of Alcor and has a ton of cryonics resources listed here.

A Future Fraught with Failures

There are a lot of things that have to go right (and plenty that can go wrong) in order for you to come out the other side of a cryonics program. Some of the assumptions include:

- Humans will eventually develop technology capable of reviving preserved brains and/or digitizing them and recreating your consciousness.

- You aren't particularly bothered by the philosophical quandary of whether or not a revived / digitized form of your consciousness is actually "you."

- Civilization doesn't self destruct.

- Nobody screws up / no accidents result in your body falling out of preservation. Cryonics requires ongoing maintenance at least every few months / years to top off the liquid nitrogen, at least until some superior form of low maintenance / automated preservation technology is developed.

- The company keeping you preserved retains business continuity / the legal entity overseeing your body and assets doesn't collapse.

- There's no change in public opinion / politics / laws that would prevent your resuscitation.

- Your human rights to own property are not violated by changes to your legal status.

The Millenia Portfolio

There are questions of how to maintain a portfolio for a thousand years - does it necessitate active management or can you simply HODL BTC? Elaine Ou makes some good points about how difficult it is to store value for millenia in a single asset:

If you choose to "take your bitcoin with you" then you must make several assumptions:

- Bitcoin will continue to exist and be valuable for generations.

- The Bitcoin protocol will continue making forwards-compatible changes that won't break your ability to spend funds.

- You can architect a robust key management solution that can withstand a thousand years of attacks.

Shout out to Spyros Dovas, who first introduced me to this topic in 2018 at the Athens Bitcoin Meetup. I was aware of cryopreservation but I had never though about the particularly difficult problem of HODLing keys while your body is in cold storage.

Securing Keys During Cryopreservation

The problem is that you need to keep the data / keys required for spending your wealth out of the hands of third parties while you yourself are completely under the control of a trusted third party. You're effectively in a wrench attack situation where the attacker has an unlimited amount of time! As such, the time-based defenses that I generally recommend to secure your keys against wrench attacks will not suffice.

In Spyros' talk he assumed that you'd use a brain wallet. Note that use of brain wallets is generally discouraged because humans are bad at generating entropy. But even if you memorized a highly random brain wallet, there's another fundamental problem in this scenario: it's stored in your brain. From a threat model perspective, it's probably best to assume that anyone with the resources to bring your body back to life will also have the resources to scan your brain and find any secrets it contains. As such, this should be treated similar to a wrench attack scenario, but one in which the attacker has unlimited time to interrogate you.

But this situation is even worse because it applies to ANY architecture that you set up to self custody your bitcoin. Let's say that instead of memorizing your seed phrase, you decide to scatter your keys around the world and create a "treasure hunt" that's required to spend the funds. Any information that is in your brain can similarly be decoded and used by an attacker to leisurely follow the treasure hunt themselves.

At this point an astute Bitcoin user might suggest that the problem can be solved with timelocks. This is once again an unknowable problem given that you have no clue as to if and when you will be revived. A simple timelock on your funds is insufficient as the cryogenic preservation company may simply wait for the timelock to expire. Also, timelocks make your wallet setup more brittle - if an attacker starts to slowly compromise aspects of your wallet, there's nothing you can do to counter the attacker. For example, if an attacker is slowly succeeding in taking control of keys to a timelocked multisig setup, if you discover this is happening then the optimal path forward is to create a new setup and move funds to it. If the funds are also locked with a time parameter, that is no longer an option. And if the attacker manages to gain control of enough keys to move the funds once the timelock expires, you enter into a very unfortunate "race to the bottom" scenario to move the funds once the lock time is passed. That is, both you and the attacker will broadcast transactions that pay higher and higher mining fees that move the funds to a new wallet you control in the hopes that your transaction will be the one confirmed in a block.

Would a distributed multi-signature setup suffice? This becomes more of a game theory problem because the issue is WHO controls the keys. If no one knows how to access the keys other than yourself, you run into the same problem as the brain wallet vulnerability. That is, the custodian of your body could theoretically extract all the information needed to find your keys and use them to spend the funds. If we're considering a distributed custody scenario, it requires many generations of your descendants / trustees to remain aligned. Point being, I think the key security is only part of the problem - the foundation upon which your long term security rests is one of incentives.

What about a multigenerational trust? Perhaps it makes sense to rely upon legal contracts rather than cryptography. This is quite challenging to architect because very few governments / nation states / empires (the entities that enforce legal contracts) last a thousand years. Estate planning is already tricky enough because it's so dependent upon the laws of the jurisdiction in which you expect the estate process to be executed. But if we're talking about a process that may not be executed for centuries, who's to say if the jurisdiction will even exist?

There are also questions of protocol longevity and forward compatibility. After all, Bitcoin has only existed for 13 years and we're trying to think through how to store it for centuries or millennia. Both technology and civilization as a whole are extremely volatile over such lengthy periods of time.

There's also the known threat of quantum computing. It's extremely important that your cold storage funds are not in addresses that have ever been spent from, otherwise you have exposed the public keys to those addresses and they could be used by a quantum computer in the future to reverse engineer the private keys. Quantumphobic users should also avoid storing funds in taproot addresses, as they expose the public key.

Forms of Authentication

There are several classes of authentication that are used to protect access to assets.

- Something you have (such as a unique physical object)

- Something you know (a secret)

- Something you are (biometrics)

Unfortunately, being in a cryopreserved state is essentially like being a prisoner.

- Anything that you have, your captors have.

- Anything you know, your captors may know.

- Anything you are, your captors control.

Is it possible to create a sort of personalized Turing test that could be used as authentication? Such that in order to authenticate, your consciousness would have to be revived? The challenge for such a form of authentication would be proving that an attacker hasn't merely revived a sandboxed simulation of you that they will turn back off after retrieving the information they're seeking.

Static vs Dynamic Security

Static systems are brittle; they can be extremely robust against a single point-in-time attack, but it should be clear by now that in order for systems to be robust over extremely long periods of time, they must be able to adapt. This is why we made key rotation an extremely simple process for Casa clients - we know that keys tend to get lost or compromised over long periods of time, so it needs to be easy for non-technical folks to recover from those scenarios and restore the full security of their vault.

One thing that came to mind was a factoid from the final book of the Ender's Game series. In this book the main characters have been traveling at near light speed for most of their lives and thousands of years had passed. During that period of time their wealth was invested and compounded to the point that they had more money than they could ever possibly spend. How? They had a financial manager - Jane. One plausible solution (that's not yet possible) would be to have your body and assets overseen by an autonomous agent (artificial intelligence) that was programmed to always be loyal and serve your best interests. Of course, this is still not foolproof but one hopes it could be made far more reliable than trusting many generations of fickle humans.

Incentivizing Your Resurrection

Cryonics is a process with 3 phases:

- Vitrification (to prevent ice crystals from forming when body is frozen)

- Preservation (maintaining the body in a frozen state to prevent decomposition)

- Resuscitation (reviving the body, or at least the consciousness of the person)

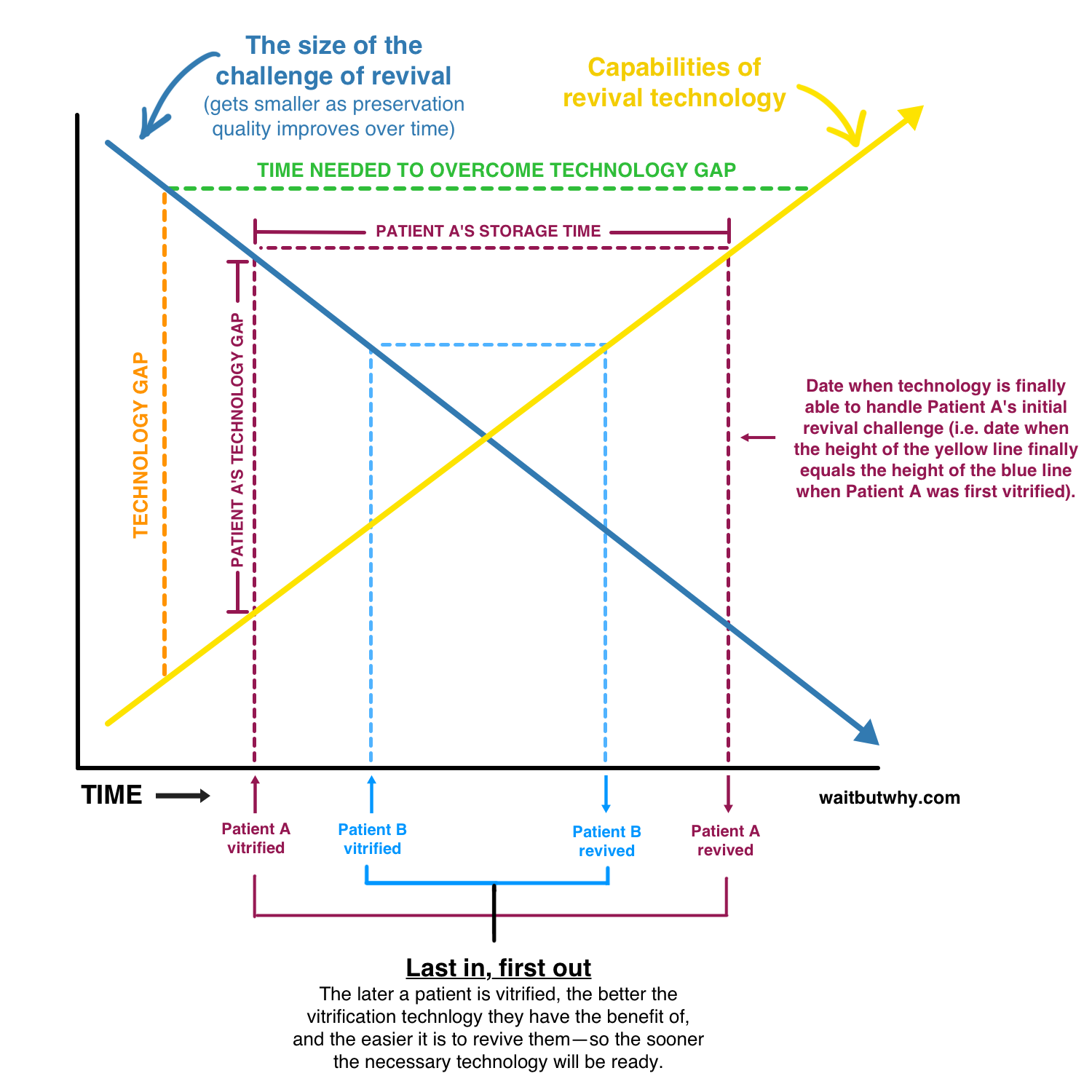

Cryogenics creates a LIFO (last-in, first out) storage system. This is because the earlier adopters will not be preserved at the same level of quality as later adopters, thus the medical technology required to revive them at an acceptable fidelity will be higher, requiring them to wait longer for the more advanced technology to be developed.

Why would people in the far future want to resuscitate you? You will be irrelevant! As a time traveler you should expect language barriers, communication issues, cultural friction, lack of skills applicable to the current economy. You won't have any friends or relatives alive. You'll likely be considered an obsolete relic, a mere curiosity of a bygone age. You'll be a stranger in a strange land, essentially having to start over from scratch.

Unless you're a celebrity / historical figure / particularly exceptional person, you'll need some additional incentives to get people to put effort into bringing you back to life. The real question is: what value do you have that you can offer to the future? Money? Perhaps, though any specific fiat money is unlikely to last thousands of years - the average lifespan of a fiat system is only around 20 years. I would posit that Bitcoin, while only being 13 years old, is much more likely to outlast fiat systems, because the system itself is architected so that it evolves in ways that are least harmful to existing adopters. Other assets held and managed by trusts and companies could also work, though very few such entities have lasted longer than 10 generations. Investing in equities will certainly require active management at these time scales.

One non-financial form of incentivization is known as the "Domino of Love." The gist is this: you can incentivize your resuscitation by instilling the belief in cryo preservation in your children, who will do the same with their children, and so on. Once the first generation of your descendants is revived then (hopefully) they will have a desire to resuscitate their parents, who will do the same, and so on, all the way back to you.

To incentivize the cryo company you'll want to enter into a contract with them that pays out a bounty upon your successful resuscitation. I struggle to think of a way to do this in a trust-minimized fashion due to the oracle problem. There is (currently) no Proof of Life protocol that can be used as an input to unlock asset to a cryptographically secured asset. As such, it still makes sense to use the legal framework of a Trust and set it up with the right incentives to be managed by professionals for centuries.

One issue to be aware of is that any assets that are frozen pending your resuscitation could result in you yourself becoming an asset.

In the cyberpunk future cryogenic companies will take out loans collateralized by the frozen bitcoiner brains they custody and the secrets they can cryptographically unlock if they are revived.

— Jameson Lopp (@lopp) November 19, 2018

If you're interested in reading a dystopian future scenario for cryogenically preserved humans, I highly recommend the Bobiverse series.

What's the Solution?

After spending weeks researching, ruminating, and conferring with experts, I've yet to settle on a single solution that is not susceptible to failure over an indeterminate period of time. But we must keep in mind that cryonics is a "moonshot" technology - the expectation that you will be revived is quite low. Thus, while a guaranteed robust wealth storage solution would be preferable, it's acceptable to simply give it our best shot.

As such, my current recommendation would be to go with a "spray and pray" approach. Spread out your assets amongst many different legal and technical storage options with the assumption that they are likely to fail. If you manage to thread the needle and wake up in a thousand years with only 1% of your assets still available, you'll likely be financially independent due to the magic of compounding and deflation.

Protecting Multigenerational Wealth

Wealth management experts will tell you that in most cases when someone acquires multigenerational wealth, their family ends up losing it all within 1 or 2 generations. The families that successfully retain this level of wealth tend to imbue values in their offspring to work on thoughtfully maintaining it. For a deep dive into this topic I suggest reading "Wealth" by Stuart Lucas.

Point being: I'm much more skeptical of a "set it and forget it" solution to this problem. I think dynamic security / active management is more likely to succeed, but that requires navigating a much more complex environment of incentives for professional managers and family values for your descendants.

Macro Issues With Cryopreserved Wealth

Ralph Merkle has estimated that, at scale, massive cryopreservation can be attained at a cost of under a dollar per person per year. It's feasible that this could become a technology that reaches mainstream adoption.

What happens if cryopreservation becomes the norm and many people who die "take their assets with them?" This could result in massive amounts of wealth being locked up for insanely long periods of time. What are the second and third order effects of "the top 1%" of wealth owners all being dead? It seems to me that this could cause massive deflation as the first few generations of people went in but it would taper off over many generations. Then due to LIFO as people were revived we'd see an inverse curve of slight inflation that ramps up to massive inflation as larger and large swaths of assets and money supply became liquid once more. But that's a topic for another time...