Satoshi Roundtable VII Recap

Another year, another Roundtable! I believe this is the first ever summer roundtable due to COVID; unfortunately many invitees were still unable to join due to travel restrictions.

As usual for this unconference I chose to attend sessions that I felt I wasn't an expert on in order to maximize my learning opportunities. The following are the insights I gained from the discussions in which I participated.

Memory Improvement Techniques

The Roundtable kicked off with a session about memory. We learned that memory and experience are two sides of the same coin; without a good memory you won't retain the wisdom gained from your experiences. Memory techniques are not just for parlor tricks; they can be applied to many different subjects including poetry and philosophy.

An interesting tie-in to the space is that cash is memoryless whereas Bitcoin has memory - the ownership of every transaction output that has ever been owned is permanently preserved.

What can the human mind achieve in a short period of time? The record for memorization is 2700 binary digits in 30 minutes.

There are 3 pillars to building a Memory Palace

- Break things into small pieces

- Deeply process the information

- Arrange the info around a superstructure

We then went on to perform an exercise that allowed us to memorize 20 random words and recall it. This was a demonstration in how you might memorize a seed phrase, for example - though I still advise against using your brain as a single backup mechanism!

Lightning Network as the Next Internet

In this session we discussed the implications of the fact that Lightning Network can be used as an arbitrary data transfer protocol. Though there are limitations on bandwidth, so you'd only want to use it for transferring small / important / semi-sensitive data. Perhaps you could use LN as a data messaging layer to transfer pointers to files hosted elsewhere such as IPFS.

There are also scalability questions with regard to data storage; we don't want to crash nodes by filling them up with junk.

Because Lightning Network is a tor-like network, some use cases for tor might be replaceable by LN. For example, you could initiate an encrypted comms channel by sending a 1 sat payment with pubkeys in the message.

Sphinx chat is one example of a data messaging app that is already up and running. I myself have tried to use it a few times but am still working through some issues with the setup.

Consider that all existing payment networks are closed intranets. Lightning Network is the open version. We expect the structure of LN to look similar to existing economic network structures but the key difference is that it's open and permissionless.

Note that LN growth started jumping in April of 2021, there are multiple groups of folks coordinating liquidity organically.

Questions of network fragility due to many folks running on Raspberry Pi devices behind NATs possibly with poor ISP connectivity or power quality causing hard shutdowns without a UPS. Personally I believe at-home nodes will be relegated to more technical hobbyists due to the ongoing maintenance requirements. You can't really plug it in and forget it.

Making Bitcoin Usable

How can we scale Bitcoin as both a store of value and medium of exchange?

- Lightning Network

- Custodial providers

El Salvador is airdropping $135M in BTC - we expect many will simply sell theirs. But it will doubtless be a massive educational boost for Bitcoin in that region.

$30 per person who KYCs is equivalent to an American getting thousands of dollars relative to the average wages in each country. This is a pretty massive incentive for people to take notice.

70% of El Salvador is unbanked; the ability to provide citizens with digital wallets that can be accessed on cheap Android phones may truly be a watershed moment for "banking the unbanked."

The interactive nature of LN, on the other hand, can cause usability issues. Since it requires both parties to be online it may not work well in 3rd world countries with poor internet infrastructure. On the flip side, pretty much every modern point of sale system requires being online in order to function.

Citizens are rightfully concerned about the government controlling the wallet - the Chibre wallet is custodial.

How do we build a circular economy? Many businesses in El Salvador are cash-only and unregistered. Requiring them to use a high tech payment solution and potentially one run by the government may actually be undesirable.

Another potential improvement is for the already sizable remittance market - if every El Salvadorean gets a wallet then they can receive remittances from relatives abroad, likely much cheaper and faster than via traditional payment rails.

Bitcoin DeFi

DeFi markets strive to keep the value of different assets that are locked in balance. They exposes users to different types of risk compared to custodial markets.

- impermanent loss - you end up with less of one of your assets

- smart contract risk - all users may lose everything

Thorchain

This is a new network that tries to improve upon the first iteration of decentralized exchanges.

- earn yield on native (unwrapped) assets

- dozens of nodes use threshold signatures to coordinate flow of funds

- Ex: to swap BTC->ETH it actually performs a double swap of BTC->RUNE and RUNE->ETH

Sovryn

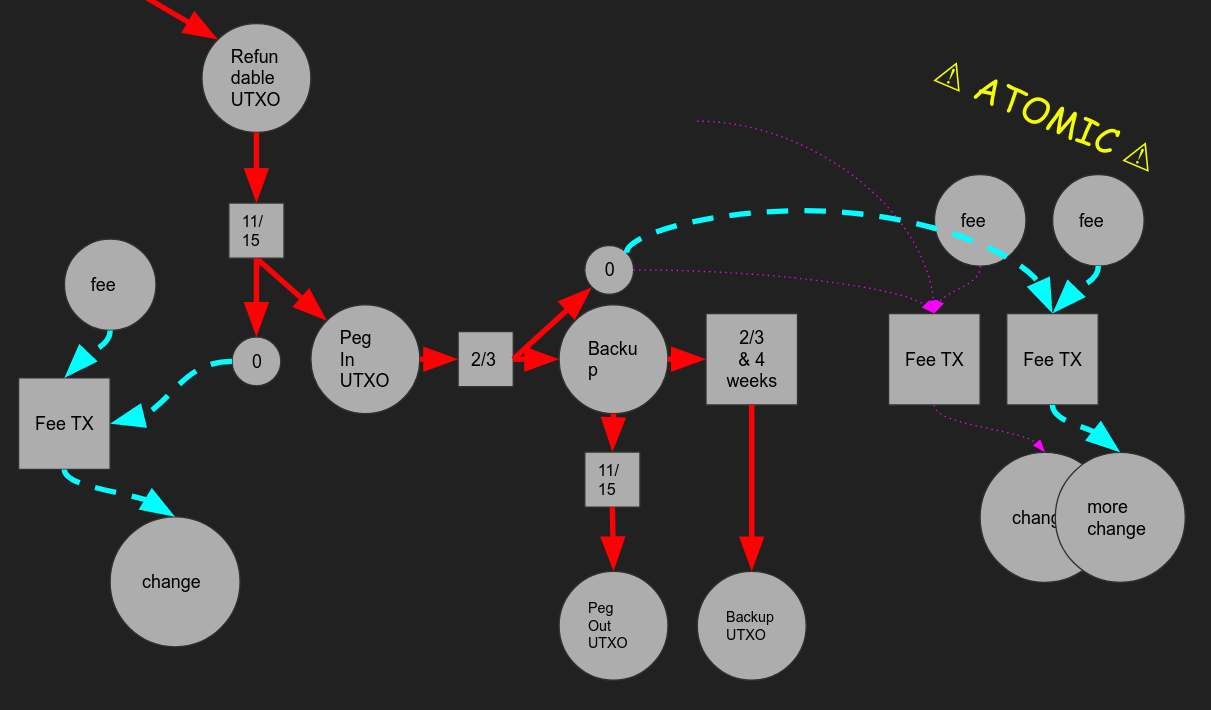

- peg in and out via RSK

- Lend & borrow just like on Ethereum AMMs

- RSK now has an emergency peg out system

Native Bitcoin scripts

- Discrete Log Contracts - bonded oracles, can use a threshold of multiple oracles to reduce oracle risk

- Sapio

- Hard to create dynamic membership systems with Bitcoin scripts vs EVM smart contracts

- No need to worry about governance of a more complex system since these are more like OTC contracts

Being a Good Bitcoin Citizen

What is Bitcoin? How do we determine what people want? The process for seeking consensus can be messy.

Miners want stability and to not kill the golden goose, but they also want long term innovation to increase usage.

The barrier to entry to develop applications is certainly lower on Ethereum. We have seen more innovative capitalism on Ethereum but there is more risk of your business model becoming defunct a la gastoken.

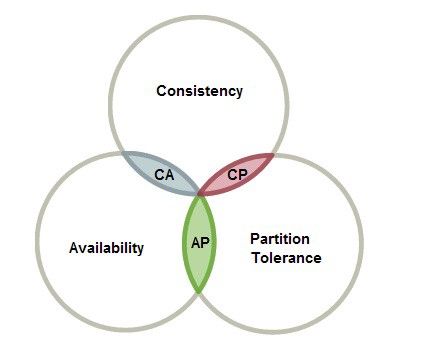

There's also the issue of multiple implementations; CAP Theorem applies. There is a reason why Satoshi said that a second implementation could be "a menace to the network."

Layer 2 networks have less consistency but more availability if you consider that bitcoin only has "heartbeats" every ~10 minutes.

The Bitcoin development ecosystem is more adversarial though not necessarily less welcoming at the application layer.

Miniscript is a great tooling development but far from becoming an accepted standard; unclear if it will evolve to meet everyone's needs. For example, you can't re-use a pubkey in miniscript.

Bitcoin suffers from the tyranny of structurelessness.

- Pro: no concrete target to be attacked

- Con: harder for developers to know how to push forward with advocating improvements

Perhaps we need X Prize style grants. Though I recall some bounties of this nature being posted on Bitcoin talk threads back in the day. They were hit or miss, probably because the people posting the bounties were fallible individuals. I recall we did get the famous "What is Bitcoin" video from such a bounty.

On the other hand, some more complex technical bounties lay dormant for many years and then when someone tried to claim them, it was hard to get paid out. Perhaps X Prize style grants from larger organizations would be more trustworthy for folks to expend resources trying to claim.

"Bitcoin protocol evolution is like going to an omakase restaurant."

Bitcoin Smart Contracts

For this session we focused on native bitcoin scripts rather than federated sidechains that offer EVM functionality.

One way of thinking about Bitcoin smart contracts is like CPU architecture.

- transistors, gates, circuits, software

- script, miniscript, PSBT, wallet software

Sapio is a language for defining a graph of potential transaction flows.

Since Bitcoin is a UTXO model it's important for state transitions to be well defined; circuit inputs are not dynamic like with EVM smart contracts.

If you design the circuit wrong then you have to scrap the whole design and start over; you can't iterate / upgrade on the fly.

Unlike EVM contracts, other circuits can't affect yours.

Discreet Log Contracts still suffer from the oracle problem, but oracles can be bonded such that if they sign multiple outcomes, their private key can be reconstructed and funds swept. But couldn't they simply sweep their own funds first?

You can also create timeout escape hatches for oracles that become unresponsive so that funds return to the original owners.

Financial Astrology 101

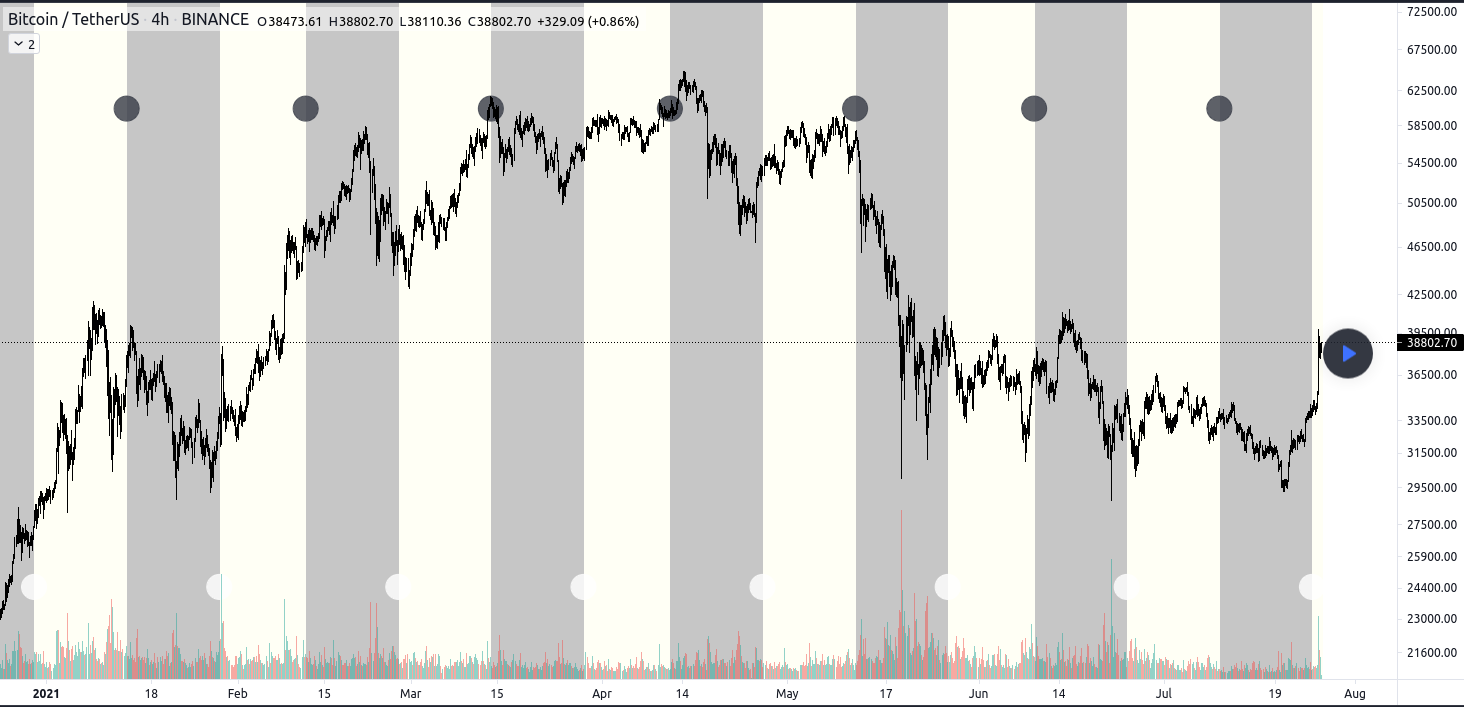

This was a fun session; naturally none of the following is investment advice.

Astrology is not causation, just correlation.

We being by looking at the position of planets as of Bitcoin's genesis. This is a bit tricky because Bitcoin could be considered to have multiple dates of creation. The whitepaper / genesis block date / first code release / first mined block? Bitcoin's astral chart is also less well defined because there is no physical position (on Earth) for the genesis.

While there are many astral bodies, certain planets like Mercury are more related to price fundamentals.

The 28 day lunar cycle is a simple indicator

- Local tops and bottoms in well establish assets follow lunar cycle

- "short the new moon, long the full moon"

There are 10 planetary bodies and each has 2 major elliptic points

- Venus & Jupiter portend of good news

- Mercury and Mars are bad news

You can find lunar cycle charts on tradingview here

Astral-Seek software helps you backtest and make forward-looking predictions.

"Ethereum's astrological chart is highly unfavorable."

Foreboding signs for late 2022 due to the end of the 250 year Pluto cycle!

Decentralizing a Company

Not all companies can be decentralized, but as more technology is built to enable decentralized coordination, the possibilities widen.

Why decentralize a company?

- To become more competitive by vastly expanding team working on it.

- To focus more on the mission than the organization; employees switch from "working for a company" to "working on a project."

- To decrease its regulatory attack surface; if you don't perform regulated actions then you won't be under regulatory scrutiny. Strive to simply be a software provider.

How do you decentralize a company? One piece at a time.

- Product must be open sourced.

- Infrastructure must be server-less.

- Corporate entities must be dissolved.

Since there will no longer be a corporation to pay salaries and give equity, you'll need a DAO to replace those functions. You may also want a token so that participants can express their interest in the direction of the project.

In the future, issuing a token and forming a DAO may be considered a new type of exit event alongside more traditional exits such as to IPO / acquisition / merger.

Decentralized Identity

Reputation, attestation, and delegation are important primitives needed for a crypto native ecosystem.

We need an agnostic network that is uncapturable and not run by a for-profit company. There are a number of organizations involved in the Decentralized Identity Foundation and we've seen Microsoft's Identity Overlay Network

The W3C has published a Decentralized Identifier specification.

We should only need to reveal the minimal amount of info to a counterparty who requests it. There's a ton of potential for tying a variety of attestations to your DID. For example:

- a government agency could attest that you're over 21 so that you need not reveal your exact birthday.

- A local or state agency could attest that you're a resident of a given jurisdiction without revealing your exact address.

- An accountant or institution could attest that your bitcoin assets exceed a certain value to help you achieve a line of credit without revealing your total assets.

Development of DIDs has been ongoing for several years; adoption has seemed pretty slow. There is a bit of a network bootstrapping issue with this type of technology - you preferably want everyone on the same standard, but it's tough to get early adopters since you don't know which platform will end up taking most of the market share.

Conclusion

While this Roundtable was odd for a multitude of reasons, and the crypto markets were in a mini bear, attendees were bullish as ever. It was some welcome respite to attend my first even in over 18th months and not have it be a jam packed hectic conference. Hopefully SRT VIII will take us back to normality!