Sovereignty vs Society

Bitcoin enthusiasts talk about the concept of sovereignty quite often; it is a value we hold dear. The ability to operate as a sovereign entity within the Bitcoin economy by holding your own keys, auditing the history of the blockchain, and enforcing the rules to which you agree is how individuals empower themselves.

However, there are nuances to this view that have become clearer to me as we have explored the governance of the Bitcoin protocol in more depth since the scaling debates 6 years ago. Consider this:

"For privacy to be widespread it must be part of a social contract. People must come and together deploy these systems for the common good. Privacy only extends so far as the cooperation of one's fellows in society."

- Eric Hughes, "A Cypherpunk's Manifesto"

You may be triggered by the word "social contract," but we'll delve into that a bit later. I think Eric's quote is relevant because it refers to an issue related to network effects. While we are all individuals, if we are going to live our lives in a way that requires interacting with other humans then we are relying upon some level of cooperation. This holds true for economic interactions, communications, and of course any other network-like activity such as those reliant upon protocols.

I pose to you that Eric's quote also works if you substitute "privacy" with "sovereignty." This essay is my attempt to convince you of that claim.

No man is an island entire of itself,

Every man is a piece of the continent,

A part of the main.

If a clod be washed away by the sea,

Europe is the less,

As well as if a promontory were,

As well as any manor of thy friend's,

Or of thine own were.

Any man's death diminishes me,

Because I am involved in mankind.

And therefore never send to know for whom the bell tolls;

It tolls for thee.

- John Donne

If you're reading this, it's highly unlikely that you are "an island" that is not reliant upon interacting with any other humans as a part of your daily life.

What is Sovereignty?

Sovereignty is independence; the freedom to operate without asking permission. Often attributed to nations, one can also become a sovereign individual in a limited capacity.

There are many facets of ones' life in which one can be sovereign. Bitcoiners, of course, focus on financial sovereignty.

Financial Sovereignty is great, but we should also strive for:

— Jameson Lopp (@lopp) November 30, 2018

Data Sovereignty

Energy Sovereignty

Food Sovereignty

Water Sovereignty

Physical Sovereignty

Complete sovereignty at the individual level is nearly impossible today due to the interconnectedness of our economy and society. This is due to the specialization of tasks: individuals are more productive when we focus on doing one specific thing very well. As a result, we outsource many aspects of our lives to third party specialists who are very good at providing specific goods and services.

Even if you're a "mountain main" who lives in the middle of nowhere and is mostly independent, it's unlikely that you're living a primitive lifestyle. Most of those folks are still reliant on supply chains to occasionally provide them with raw materials and higher technology items they can't create from scratch. Their "islands" of humanity still have frail bridges to society.

Sovereignty Through Math & Game Theory

How does one achieve financial sovereignty from a practical standpoint? We have to begin, of course, at the beginning.

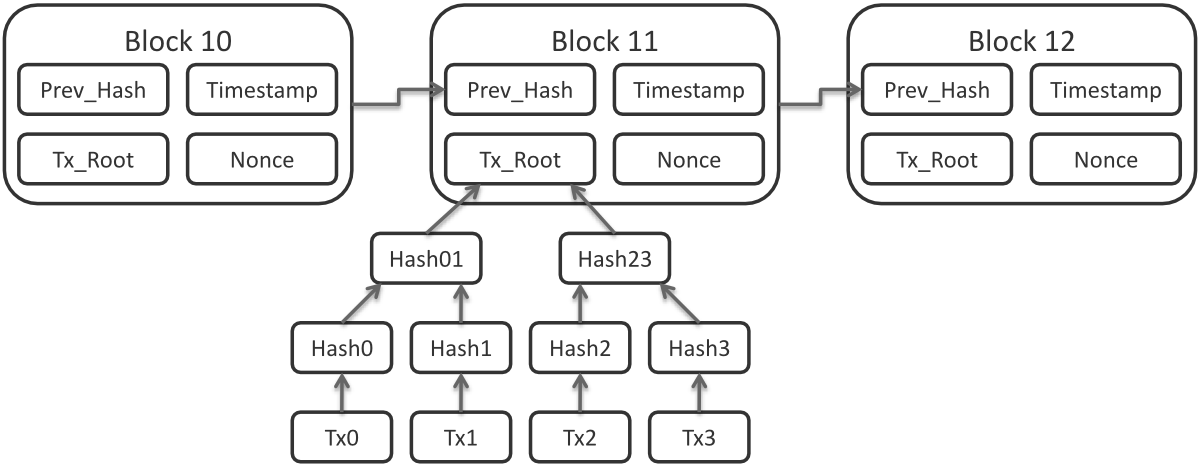

What is a blockchain? It's a chain of blocks.

I'm a technology guy. When people say "blockchain," I hear "database." When people talk about "solving problems with blockchains" they almost always gloss over a lot of the details that are critical to these architecture of these systems.

When you create a blockchain, all you're doing is creating a linked list of data, a new type of data structure that's cryptographically tied together. This data structure gives us the property of tamper evidence. That's all you really get in addition to an ordered history of events. You can say "this thing happened after this thing." Though, to be precise, you can't be sure that the ordered history you're looking at is the true history from just a blockchain data structure.

Most of the other stuff that people think of when they say blockchain is not actually guaranteed from the blockchain itself. What is a blockchain not?

- It's not a network of nodes.

- It's not a consensus protocol.

- It's not an immutable history.

- It is certainly not an arbiter of truth.

- It's not even a trustworthy timestamping service.

The blockchain itself only gives you tamper evidence. You need other things such as a proof of work or proof of stake or some sort of other consensus mechanism that makes it very expensive for someone to rewrite the blockchain. You need a network of nodes to ensure that the history is accurate. You need specific consensus rules to ensure that blocks were timestamped in a certain range.

How do blockchain-based systems enhance individual sovereignty? Cryptography enables its users to create an asymmetric shield for self defense. That is to say, the cost to attack a user who secures their data with cryptography is orders of magnitude higher than it is for the user to wield it in defense.

Similarly, by running software the validates that no one is breaking the rules of the system, we attain a level of sovereignty in that we need not trust third parties to be honest. For an in-depth explanation of how consensus forms organically in public permissionless networks, check out my presentation clip:

Consensus is achieved in these networks by each of us enforcing the rules to which we agree and thus deciding which data to accept and propagate to our peers, and which data to reject. When participants disagree on the rules and disagree on which data to accept, the network automatically partitioned. As such, the "society" with which a participant can interact is also split and the "governance" of the network as a whole is completely seamless.

In my opinion the most fair system that you can get is one in which any participant can veto anything that they want. This gives us the ability to create a system where we aren't optimizing for that which is the best for the majority (the goal of democracies.)

Rather, this architecture creates a system in which we're optimizing for that which is least harmful for the entirety of the user base.

Traditional Governance

Let's consider how human civilization has gotten to where we are right now. We have created these hierarchical command and control systems over the past several millennia to help us organize ourselves, to help us specialize so that no longer do any of you need to actually worry about growing your food and the entire process of sustaining yourself.

Instead, you can delegate those specific functions off to other people who are specialized and probably work for companies and other hierarchies to be very, very efficient and productive at doing one or two things.

The result of this is that you have a system where there is a lot of power concentration at the top, and this power is basically being used to coordinate the other layers of people who are actually getting stuff done throughout the organization. This holds true for both public and private sector organizations.

This is quite efficient, but of course, it has trade-offs. And I don't think that as a society, we've really thought about these trade-offs very much. What we gain in efficiency and convenience we lose in robustness.

Social Scalability

You hear a lot of people talking about technical scaling solutions and all of the performance problems that we have with blockchains because blockchains are probably the least efficient and least performant database structure that has ever been created.

But I think that a lot of people are overlooking the issue of social scalability. So what is social scalability?

"Civilization advances by extending the number of important operations which we can perform without thinking about them."

- Alfred Whitehead, an English mathematician and philosopher

If you think back to bureaucracy and how civilization has evolved with these command and control hierarchies, that is the great question, the trade-off of the efficiency versus the resulting systemic risk that we create by centralizing power in the hands of a few.

Thus I believe that blockchain based consensus networks can enable us to create systems that are socially scalable, which means that the cost of participating in the network and staying in the network is much lower.

And I don't mean the cost from a technical standpoint, but rather from a cognitive standpoint. If you are aware of the idea of Dunbar's number, it refers to the fact that the human brain can only really keep about 100 to 150 other relationships in play at any given time before we experience a form of cognitive overload.

When you're in a system architected such that other participants have sufficient power that they can pull the rug out from under you, change the rules, and actually change the system itself, then you have to spend a lot of time worrying about all of these other participants and how they might impose upon your sovereignty.

But if we can build robust platforms where the power is so decentralized that you can create a much more resilient and trustworthy system, then people can interact with each other and use that system with very little cognitive overhead. With public permissionless networks we can create truly free markets that are socially scalable, where we can achieve this by creating a system where you don't have to worry about all of the power dynamics and the games that are being played behind the scenes.

And we essentially do that by inverting and automating bureaucracy to create these new forms of cybersociety.

"When we can secure the most important functionality of a financial network by computer science rather than by the traditional accountants, regulators, investigators, police, and lawyers, we go from a system that is manual, local, and of inconsistent security to one that is automated, global, and much more secure."

- Nick Szabo, "Money, blockchains, and social scalability"

Property Rights

In one sense, property rights are extremely well defined within cryptographically secured protocols. Either you have the ability to present sufficient proof to the network that you own an entry in the distributed ledger and can manipulate it, or you don't.

However, at a higher level there is game theory at play. While you can be secure against your assets being stolen or frozen by some random authority, it's always possible for the ecosystem as a whole to turn on you. Due to game theory and the inverted nature of governance in public permissionless networks, this is made to be extremely unlikely due to the difficulty in coordinating such changes, but it's never impossible.

1) Public permissionless consensus systems let you use them w/o trusting any one individual. However, you must trust everyone in aggregate.

— Jameson Lopp (@lopp) June 26, 2016

Take, for example, Ethereum's response to the DAO hack. This is the most well-known example of a reaction to a perceived massive threat but it's by no means the only time a protocol has been changed in result to actions taken by a malicious entity.

In the case of the DAO hack, a sufficient amount of value was removed from the control of a sufficient number of entities on the network, such that the incentives were strong enough to coordinate a protocol change to return the funds to their original owners. The DAO attacker managed to take control of 3.6 million ETH, which was about 5% of the total supply at the time. One can logically argue, of course, that the DAO hacker was just following the rules of the protocol and took rightful ownership of those tokens, but this goes to show that not all rules are written.

Note that something similar happened to Bitcoin, though when it was a much smaller ecosystem. On August 15, 2010, it was discovered that block 74,638 contained a transaction that created 184,467,440,737.09551616 BTC spread across three different addresses. This was possible because the code used for checking transactions didn't account for the case of outputs that were so large that they overflowed when summed.

A new version of the client was published within five hours of the discovery that contained a soft forking change to the consensus rules that rejected output value overflow transactions. The blockchain was forked. Although many unpatched nodes continued to build on the "bad" blockchain, the "good" blockchain fork overtook it at a block height of 74,691 at which point all nodes accepted the "good" blockchain as the authoritative source of Bitcoin's transaction history.

On one hand, whomever exploited that vulnerability had their bitcoin taken away from them by the network at large. On the other hand, if the rule had only been patched going forward from that point, the exploiter would have ended up owning 99.9886159% of all bitcoin ever created. The incentives were quite clear.

Spock: “It is logical. The needs of the many outweigh...”

Kirk: “The needs of the few.”

Spock: “Or the one.”

Social Contracts

There's a conundrum in that it's not even possible to write a social contract because no authority can enforce it. I'd argue that the legal systems put in place by governments are an attempt at codifying the social contract.

“Everyone carries a part of society on his shoulders; no one is relieved of his share of responsibility by others. And no one can find a safe way out for himself if society is sweeping toward destruction. Therefore, everyone, in his own interests, must thrust himself vigorously into the intellectual battle. None can stand aside with unconcern; the interest of everyone hangs on the result. Whether he chooses or not, every man is drawn into the great historical struggle, the decisive battle into which our epoch has plunged us.”

- Ludwig Von Mises

It seems to me that the "social contract" is just a euphemism for "the lowest common denominator of beliefs across humans in a given organization." It is ethereal, difficult to define, and subject to change. Despite all of our advances in advancing machine consensus to automate the enforcement of rules across a society, it seems we will be forever constrained by the messy unquantifiable nature of human consensus.

Opt-In vs Opt-Out Society

The great thing about creating public permissionless networks that are secured by cryptography is that those who choose to participate do so out of their own interest. Anyone who is using Bitcoin today is doing so because they have opted in to this system of rules. Though that may not always be the case in the future, if more nation states decide to adopt it as legal tender.

Contrast that with something like the Free State Project that is basically "invading" an existing society (New Hampshire) and attempting to subvert it from within. The latter is sure to be a more challenging road, battling incumbents rather than "homesteading" pristine unclaimed ground.

Bitcoin's Social Contract

What is Bitcoin's social contract? I often refer to the set of "inviolable properties" that are generally agreed upon by users.

- Consensus, Not Command & Control: governance rests upon the Cypherpunk principle of rough consensus and running code.

- Trust Minimization: trust makes systems brittle, opaque, and costly to operate. Trust failures result in systemic collapses, trust curation creates inequality and monopoly lock-in, and naturally arising trust choke-points can be abused to deny access to due process.

- Decentralization: of many attributes, but power is what matters most.

- Censorship Resistance: No one should have the power to prevent others from interacting with the Bitcoin network. Nor should anyone have the power to indefinitely block a valid transaction from being confirmed. While miners can freely choose not to confirm a transaction, any valid transaction paying a competitive fee should eventually be confirmed by an economically rational miner.

- Pseudonymity: No official identification should be required to own or use Bitcoin. This principle strengthens the censorship resistance and fungibility of the system, as it is more difficult to select transactions to consider “tainted” when the system itself does not keep track of users.

- Open Source: Bitcoin client source code should always be open for anyone to read, modify, copy, and share. Bitcoin’s value is built upon the transparency and auditability of the system. The ability to audit any aspect of the system ensures that we need not trust any specific entities to act honestly.

- Permissionless: No arbitrary gatekeepers should be able to prevent anyone from participating on the network (as a transactor, node, miner, etc). This is a result of trust minimization, censorship resistance, and pseudonymity.

- Legal Indifference: Bitcoin should be unconcerned with the laws of nation states, just like other Internet protocols. Regulators will have to figure out how to respond to the functionality enabled by Bitcoin-powered technology, not the other way around.

- Fungibility: Fungibility is an important property of sound money. If every user needed to perform taint analysis on all the funds they received, then the utility of the system would drop significantly.

- Forward Compatibility: Bitcoin supports signing transactions without broadcasting them; there is a principle that any currently possible signed but not broadcast transactions should remain valid and broadcastable. The fact that Bitcoin has stuck to this principle gives everyone confidence in the protocol. Anyone can secure their funds by whatever scheme they dream up and deploy it without needing permission.

- Resource Minimization: In order to keep verification costs low, block space is scarce. As such, it should be expensive for anyone to consume a lot of block space. Validation should be cheap because it supports trust minimization if more users can afford to audit the system; cheap validation also makes resource exhaustion attacks expensive.

- Convergence: Any two Bitcoin clients, if they connect to a single honest peer, should eventually converge on the same chain tip.

- Transaction Immutability: Each additional block added to the chain after a given block should make it far less likely that the given block will be orphaned by a chain reorganization. While there can technically be no guarantee of immutability, we can guarantee that it becomes impractically expensive to reverse a transaction after it is sufficiently buried under enough proof of work.

- Conservatism: Money should be stable in the long run. We should be conservative about making changes, both in order to minimize risk to the system, and to allow people to continue using the system in the way they see fit.

Sovereignty Inside the System, not Against the System

Systems like Bitcoin are superior because their incentives and governance are more transparent, despite the governance process and power distribution being poorly defined. Some would say that's a feature in and of itself.

We are all capable of being sovereign in limited ways, but we are reliant upon cooperation with others in society to engage in trade and provide us with the products of their labor. Recall that our bitcoin only has value because some set of people around the world agrees with us that it has value. Remember that "no man is an island."

Generational Impositions Upon Sovereignty

While opt-in cybersocieties are arguably better than traditional nation and city-state governance that is backed by threats of violence, what if the concept of opt-in society still fails at generational timescales?

One issue I've revisited several times over the years is related to the cycles we see in civilization.

“Hard times create strong men.

Strong men create good times.

Good times create weak men.

And, weak men create hard times.”

― G. Michael Hopf

I believe there's something of a moral dilemma given that a society may choose to reorganize itself and form a new system of government and laws. But those laws tend to exist in perpetuity and are imposed upon future generations. If society changes and decides the laws no longer fit their desired social contract, it can be quite difficult to change them peacefully.

This is because defaults tend to be extremely sticky. If we observe the rise and fall of empires, then tend to collapse as a result of greater and greater amounts of bureacracy being imposed upon society, until either the populace revolts or the system collapses upon itself due to resource exhaustion and inability to react to changing environments. I've often wondered if it wouldn't be more fair for the default to be that laws should need to be re-ratified every generation / every few decades.

Where Are We Going?

I think the open-ended question after covering all of these issues is how do you try to guide the evolution of a social contract? I think it's an issue of culture, narratives, and memetics.

“My prediction is that libertarians are going to turn on Bitcoin. That’ll be in about two years, when it’ll be mainstream. I don’t know how you get fringe technology without fringe people and politics … You just need to go through a maturation process where the technology emerges as mainstream at the other end. Along the way the fringe politics will move on."

- Marc Andreesen, 2014

While Marc's prediction has failed to come to fruition, he was onto something. If an opt-in society goes from small and niche to large and mainstream, it's possible for the newcomers to bring in their own culture and values, which can change the unwritten social contract, which can then lead to people making an attempt to change the written and codified rules. Since libertarian ideals are "fringe" then it's certainly possible that mainstream adoption of Bitcoin could result in the social contract of the system morphing into something with weaker assurances.

I think one saving grace we have in Bitcoin is that the earliest adopters who hold strong ideological beliefs, a lot of bitcoin, and a lot of influence and power over enterprises in this space will not be easily swayed. It's an open question of how the game theory will play out.

What can you, dear reader, do to contribute to the continued integrity of Bitcoin's social contract and the properties we hold as inviolable?

- Run your own node to enforce the rules on your funds.

- Take custody of your keys

- Educate your friends and family

The onus is upon us all to ensure that the system remains robust, reacts to new threats, and is not corrupted from within.

"Vigilance is not only the price of liberty, but of success of any sort."

- Henry Ward Beecher