Bitcoin 2022 Annual Review

I’ve always been fascinated with the raw numbers relating to the operational status and growth of Bitcoin, especially as we ride the rollercoaster of the adoption life cycle. This interest spurred me to create Statoshi.info in 2014 to track bitcoin metrics from the perspective of a full node.

To that same end, I’ve compiled statistical measurements of Bitcoin’s growth in 2022 from a variety of sources. It can be difficult to see all of the moving pieces since the data is so distributed, but the picture becomes clearer when you bring them all together.

The one theme that I've taken away from all of these metrics is that 2022 was typically painful Bitcoin bear market; we have once again persevered through some significant setbacks.

Bitcoin is at the forefront of an increasingly complex ecosystem that continues to grow in a variety of ways. And for the 14th straight year, it stubbornly refused to die!

Bitcoin Obituaries:

— Jameson Lopp (@lopp) December 16, 2022

2010: 1

2011: 6

2012: 1

2013: 17

2014: 29

2015: 39

2016: 28

2017: 124

2018: 93

2019: 41

2020: 14

2021: 47

2022: 27https://t.co/K8Gna8iA4D

General Interest

Switzerland jumped from 6th to 3rd place for relative search interest in Bitcoin, probably due to the Plan B initiative in Lugano.

Countries with the highest relative search interest for Bitcoin remain relatively unchanged from 2021 to 2022. El Salvador is still Bitcoin country. pic.twitter.com/5sDQ2dZePz

— Jameson Lopp (@lopp) December 16, 2022

General interest in educational resources remained low. This makes sense, as we tend not to see many new entrants to markets when sentiment is bearish.

During 2022 an average of 279 visitors per day viewed my educational resources at https://t.co/8ZsrcEwSfa - a 50% decrease vs 2021.

— Jameson Lopp (@lopp) December 16, 2022

Twitter chatter was fairly flat, up 3% over 2021 though still up 350% over 2020.

104 million tweets containing the word "bitcoin" were posted in 2022.

— Jameson Lopp (@lopp) December 18, 2022

H/T @wullon pic.twitter.com/VKzURp9T1y

The bitcoin subreddit saw steady growth.

/r/bitcoin added another million subscribers in 2022, increasing by 29% to a total of 4,780,000. It remains in the top 100 subreddits in terms of subscribers! pic.twitter.com/C9xslshZlV

— Jameson Lopp (@lopp) December 16, 2022

I myself abandoned BitcoinTalk many years ago because I felt it was hard to find signal through the noise. It looks like user growth on that site decelerated significantly in 2022.

BitcoinTalk total registered users:

— Jameson Lopp (@lopp) December 17, 2022

2009: 19

2010: 3,127

2011: 48,827

2012: 76,680

2013: 207,357

2014: 406,833

2015: 710,256

2016: 935,550

2017: 1,346,000

2018: 2,464,000

2019: 2,718,000

2020: 2,916,000

2021: 3,412,000

2022: 3,510,000

Academic Interest

Academic interest continued to increase, which is great for the long-term prospects of this industry as we continue to gain a greater understanding of what we’re building.

Google Scholar articles published mentioning Bitcoin:

— Jameson Lopp (@lopp) December 17, 2022

2009: 83

2010: 136

2011: 218

2012: 424

2013: 868

2014: 2,070

2015: 2,820

2016: 3,380

2017: 6,460

2018: 11,500

2019: 20,300

2020: 24,000

2021: 25,600

2022: 26,100 (will ⬆️ due to listing lag)

Cryptology ePrint Archive papers mentioning Bitcoin:

— Jameson Lopp (@lopp) December 17, 2022

2011: 1

2012: 3

2013: 8

2014: 24

2015: 28

2016: 41

2017: 54

2018: 57

2019: 50

2020: 56

2021: 54

2022: 53

Funding and Forking

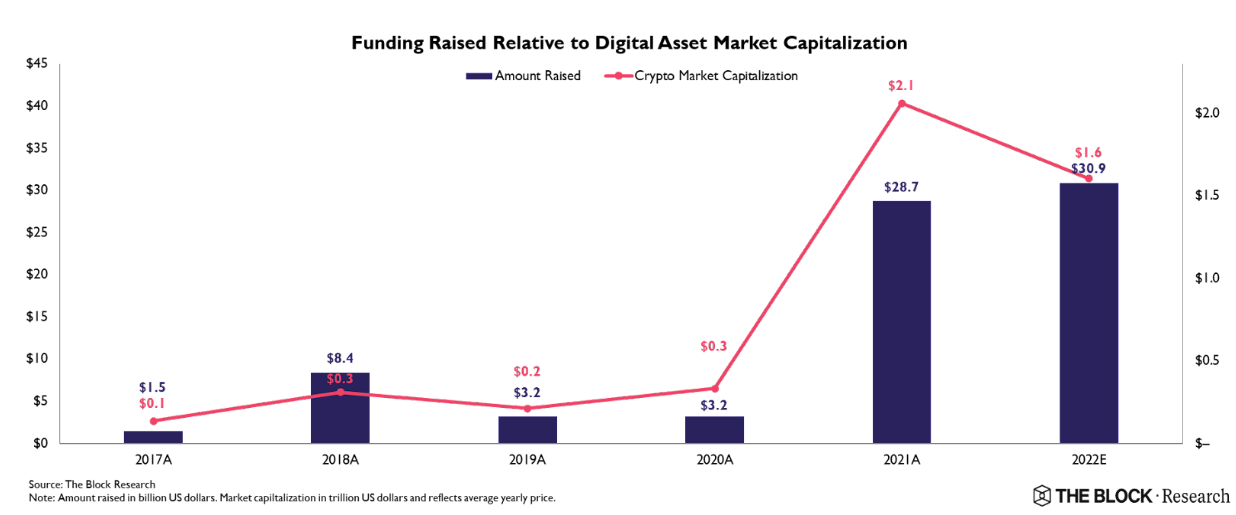

Venture capital funding has exploded as the companies that survived previous cycles are now orders of magnitude larger and raising huge late stage rounds of funding. It's worth noting that VC investment in Q4 fell off a cliff as the bear market and credit crises hit full stride. I expect 2023 will see a much smaller level of investment as VCs get excited by advancements in other tech areas such as artificial intelligence.

Crypto industry venture capital funding:

— Jameson Lopp (@lopp) December 22, 2022

2012: $23M

2013: $120M

2014: $368M

2015: $850M

2016: $850M

2017: $1,200M

2018: $6,000M

2019: $3,000M

2020: $3,500M

2021: $28,700M

2022: $30,950M

2022 saw the collapse of several highly ranked crypto tokens, which offset the decrease in BTC's exchange rate in terms of total market cap.

Bitcoin market cap dominance held steady around 40% throughout 2022 despite the decrease in exchange rate. pic.twitter.com/UrLQMZEDYf

— Jameson Lopp (@lopp) December 17, 2022

On the other hand, the "fast, cheap payments" narrative has not played out well for BCH. This is a highly competitive arena in which dozens if not hundreds of altcoins can claim to be "the best." And of course, Bitcoin itself continues to compete in this space via Lightning Network, which we'll cover later.

The BCH fork has had a bad year yet again, losing another 33% in value against BTC. Its value (and thus hashrate) is now a mere 0.6% of Bitcoin's. pic.twitter.com/6I7Or8f0OA

— Jameson Lopp (@lopp) December 17, 2022

On-Chain Transactions

While development of Lightning Network made more progress in 2022, due to its stronger privacy features we’ll always have more accurate statistics of on-chain activity.

Bitcoin's daily adjusted on-chain value transferred hovered near all-time highs above $30B several times in 2022, but has been fairly flat since summer. pic.twitter.com/gZEHnW2UTQ

— Jameson Lopp (@lopp) December 18, 2022

A more controversial aspect of the changing nature of bitcoin is the transaction fees. Rising fees caused significant frustration for users trying to transact in smaller amounts of value during late 2017 and early 2018, but fees were nearly 0 for the following 2 years due to a variety of factors. Lower transaction demand, improved fee estimation algorithms, adoption of segregated witness, transaction batching, and lightning network resulted in more efficient use of block space and less contention for this scarce resource. In 2022 we saw both demand and fees remain near floor levels due to market sentiment, though there were still record levels of value being transferred!

Revenue collected via transaction fees by bitcoin miners averaged $392,000 per day in 2022. This is quite low in comparison to bull market activity, but still far higher than what we saw in the bear markets of 2016 and 2018. pic.twitter.com/tbb5KBbvZ7

— Jameson Lopp (@lopp) December 18, 2022

The market for bitcoin block space was mostly muted in 2022. If you were willing to wait a day for confirmation, you could almost always get in with the minimum 1 sat/vb relay fee. pic.twitter.com/2a4gIN9LNb

— Jameson Lopp (@lopp) December 18, 2022

Despite the bear market both for the exchange rate and block space, Bitcoin miners appear to be doing quite well.

Bitcoin miners earned over $9 billion in 2022, a significant addition to the $47 billion total over the past 13 years. This number assumes they instantly sell for fiat, which is most certainly not the case - miners are HODLers. pic.twitter.com/91OMkT7hOr

— Jameson Lopp (@lopp) December 19, 2022

Address reuse likely has a floor set on it due to the security mechanisms at exchanges. Some estimates have put nearly half of all bitcoin transactions as being exchange-related, and the deposit/withdrawal mechanisms of exchanges tend to encourage not generating new addresses. This metric has barely changed in recent years.

Bitcoin address reuse, which is a poor privacy practice, remained flat in 2022. Half of all addresses that receive funds today are being reused. pic.twitter.com/0Dsg9bFmw7

— Jameson Lopp (@lopp) December 19, 2022

SegWit adoption has reached saturation; I expect it will take many years for us to asymptotically approach 100% adoption.

Bitcoin transactions that spent SegWit inputs inched upward during 2022 from 82% to 85%. pic.twitter.com/itYiQGPnmA

— Jameson Lopp (@lopp) December 19, 2022

UTXO set growth continued its growth trend from 2021, though you can see several major consolidations such as the 2 week long Binance consolidation they performed in November to help restore more confidence in their reserves.

Bitcoin's UTXO set grew from 78M to 83M during 2022, adding a net additional UTXO every 6 seconds. pic.twitter.com/L5EO31su8d

— Jameson Lopp (@lopp) December 19, 2022

Bitcoin Data Anchoring

While you may think of bitcoin as being a cryptocurrency, some users think of it as a trust anchor. By embedding data into Bitcoin’s blockchain, other systems can gain new properties such as tamper evidence and immutability.

The amount of outputs that embedded data into the blockchain increased at an unprecedented rate in 2019, mostly due to Veriblock's "proof of proof" mining coming online. However, since then we seem to be making a return to normal based upon what uses cases are economically justifiable. OP_RETURN creation dropped by another 34% in 2022.

Bitcoin OP_RETURN (data anchor) outputs created in:

— Jameson Lopp (@lopp) December 19, 2022

2014: 13,000

2015: 655,000

2016: 1,040,000

2017: 2,253,000

2018: 6,750,000

2019: 28,200,000

2020: 7,830,000

2021: 2,970,000

2022: 1,952,000 pic.twitter.com/3CLbd1UnsC

But OP_RETURN isn’t the only way to anchor other systems onto Bitcoin’s blockchain. Sidechains use pegging mechanisms to cryptographically lock BTC on the main chain and then allow users to unlock a proportional amount of tokens on a sidechain. This allows for experimentation with other features that are unlikely to be added to the Bitcoin protocol. At time of writing the only two production sidechains are RSK and Liquid. Work continues to progress on drivechains, though it's hard to say if and when we'll see drivechains in production use.

The Bitcoin hashrate that is merge mining the @RSKsmart blockchain dropped from 55% to 42% during 2022. (https://t.co/1CqEJ4o92h)

— Jameson Lopp (@lopp) December 19, 2022

The amount of BTC pegged into rootstock increased from 2,520 to 3,415. (https://t.co/MgPzrAfYdh)

A few interesting points to note here: I suspect the drop was due to the increase in hashrate by other pools that don't merge mine RSK, rather than miners stopping their merge mining. Also, apparently the peg-out from the RSK sidechain has been inoperable during Q4 of 2022 due to some issues with the "standardness" of the peg-out bitcoin transactions it uses.

Blockstream's Liquid sidechain also saw negligible growth in 2022.

During 2022 the amount of BTC pegged into @Blockstream's Liquid network increased 6% to 3,565.

— Jameson Lopp (@lopp) December 19, 2022

Lightning Network

The observable network remained fairly flat in 2022.

Lightning Network in 2022:

— Jameson Lopp (@lopp) December 20, 2022

# advertised channels ⬆️ 1% to 85,490

# nodes with channels ⬇️ 12% to 17,086

Bitcoin in those channels ⬆️ 60% to 5,293 BTC

Network total USD value ⬇️ 43% to $90M

NOTE: unadvertised channels and their value can't be measured.

Since we can't actually observe payments on the Lightning Network, we have to settle for anecdotal reports by major node operators about the volumes they're seeing.

🌎 The world is turning to Lightning

— River (@River) December 27, 2022

⏩ River has already routed over 3,700 Bitcoin through our Lightning nodes

River Lightning Services (RLS) empowers developers and organizations to instantly access global payments via the Lightning Network

⚡ https://t.co/XGAhSTYuvj ⚡ pic.twitter.com/uxVbz7mGaS

Lightning channel capacities continued to increase throughout 2022, likely a combination of the lower exchange rate and more node operators enabling wumbo channels. pic.twitter.com/Ku3eB0Hv5F

— Jameson Lopp (@lopp) January 1, 2023

https://t.co/lIIPfEQeeD Lightning Network Revenues:

— Alex Bosworth (@alexbosworth) December 31, 2022

2018: 0.12 BTC

2019: 0.22 BTC

2020: 0.34 BTC

2021: 1.08 BTC

2022: 1.88 BTC

Great growth continues on the Lightning Network even through a wintery period. Earning on LN gives you a personal proof point that all this is working.

DeFi

2022 saw a major unwind of lending activities and wrapped bitcoin bore the brunt of the fallout. While many like to point out that there is "more bitcoin on Ethereum than Lightning Network" these figures are hardly comparable because the security models are completely different.

Wrapped bitcoin peaked at an all-time high of nearly 286,000 BTC in 2022, but since then 35% of the supply has been unwrapped and now 186,000 WBTC remain. pic.twitter.com/eWZHwFFn61

— Jameson Lopp (@lopp) December 19, 2022

The vast majority of wrapped bitcoin are in fact custodied by BitGo for their WBTC token, so I think of this metric as more akin to a "balances on exchanges" metric.

Network Security and Health

The number of Bitcoin nodes remained steady in 2022; I'd say this is a pretty strong floor of dedicated operators (such as myself!) who will continue running nodes for our own benefit regardless of the exchange rate.

Reachable Bitcoin node count was remarkably stable in 2022 according to @port8333. These ~15,000 node operators are clearly not tourists. pic.twitter.com/fUcbKfAZo2

— Jameson Lopp (@lopp) December 20, 2022

The number of unreachable nodes (behind routers without port forwarding) was also fairly steady around 50,000. This is more evidence of a floor of dedicated Bitcoiners who have persevered through the bear market. I fully expect this number to be an indicator of retail FOMO and that it will shoot up if a bunch of newbies enter the space.

According to @LukeDashjr's estimates of unreachable / non-listening node counts, the total number of Bitcoin nodes was fairly stable during 2022, hovering around 45,000 to 50,000. pic.twitter.com/1zA13oklcX

— Jameson Lopp (@lopp) December 20, 2022

A variety of improvements in block propagation have been implemented by Bitcoin Core over the past several years; network propagation performance has been fairly consistent since 2019.

Bitcoin block propagation times were remarkably stable throughout 2022, taking an average of 613 milliseconds for a block to reach half of the nodes on the network. pic.twitter.com/c3aYs1bWLN

— Jameson Lopp (@lopp) December 20, 2022

Bitcoin transaction propagation times stabilized in 2022. The average transaction now reaches half of the nodes on the network in about 4 seconds. This is actually slower than it used to be due to intentional relay delays to help improve privacy. pic.twitter.com/I0KsHNJO3j

— Jameson Lopp (@lopp) December 20, 2022

While the global hashrate only went up 10% in 2021, mainly due to the major setback with China completely banning mining, 2022 has resumed the upward trajectory to all-time highs.

Bitcoin's network hashrate increased by 56% during 2022, from 175 to 274 exahash per second. pic.twitter.com/j4HfhA1CCO

— Jameson Lopp (@lopp) January 1, 2023

The proof-of-work equivalent days is an interesting metric though it should not be construed as a reasonable attack that we should be worried about. Theoretically an attacker could have 1,000% of the total network hashrate or more and perform various block reorganization and double spending attacks. Practically, of course, there are physical limitations to acquiring that level of hardware and electricity.

Bitcoin POW Equivalent Days hit new all-time highs in 2022.

— Jameson Lopp (@lopp) January 1, 2023

An attacker with 100% of the current hashrate would have to spend over 2 years mining in order to accumulate enough work to rewrite the entire bitcoin blockchain. pic.twitter.com/d1XZNlBHyQ

The growth in global hashrate has been not merely increasing, but has been accelerating since genesis. My prediction in last year's review that 2022 would accelerate growth even faster due to major investments in infrastructure appears to have come true.

Bitcoin's thermodynamic security accelerated at an average rate of 3,139 GH/s^2 in 2022.https://t.co/KVpKmBu3gk

— Jameson Lopp (@lopp) January 1, 2023

However, from recent reports we can see that a lot of the newer industrial mining operations are now in distress due to overleveraging their operations. I'd expect that 2023 will see a delayed fallout and thus slower network growth as some of these larger operations go out of business and are acquired by the survivors.

15% of all bitcoin mined in 2022 was generated by publicly traded companies. Core Scientific, which just filed for bankruptcy, accounted for a quarter of that. pic.twitter.com/MNKvAhkqra

— Jameson Lopp (@lopp) December 22, 2022

In terms of general ecosystem security, 2022 was an amazing year! Major hacks cause loss in confidence in the system and can serve as major setbacks even though they have nothing to do with the protocol or network security. Of course, the flip side is that 2022 saw a multitude of losses due to fraud and poor risk management by trusted third parties... which ought to make folks more bullish on self custody!

As far as I can tell, only 1,135 BTC were stolen in publicly announced hacks in 2022. (@cryptocom and @DeribitExchange)

— Jameson Lopp (@lopp) January 1, 2023

A drop in the bucket compared to the $4B+ in thefts perpetrated across the wider crypto ecosystem.

Physical attacks tend to be correlated with the exchange rate; the bear market has reduced the risk of attack (for now.)

Known Bitcoin related physical attacks in

— Jameson Lopp (@lopp) December 20, 2022

2014: 1

2015: 5

2016: 4

2017: 12

2018: 25

2019: 8

2020: 14

2021: 33

2022: 23

Cost of Node Operation

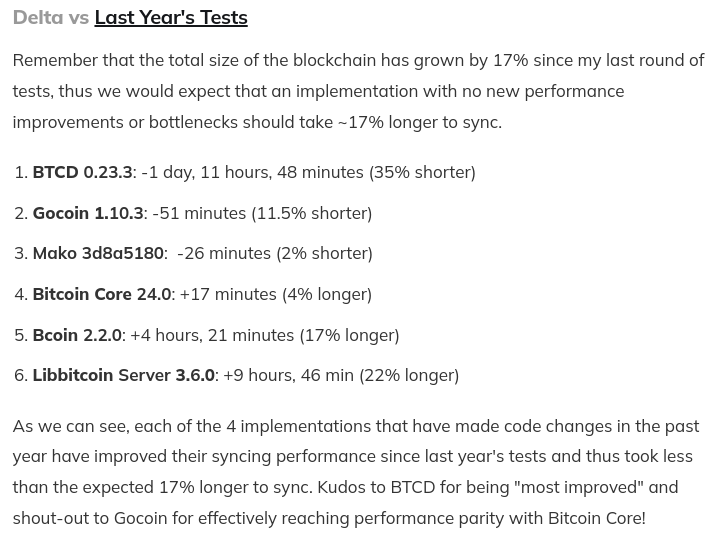

Anyone who has been following the Bitcoin space for long is likely aware of the scaling debate that resulted in a variety of both software forks and blockchain forks. The good news for node operators is that it appears the resources required to fully validate the entire history of the blockchain are decelerating, meaning that node operators should be able to take advantage of the deflationary nature of technology.

I ran performance tests of every Bitcoin client and sync performance improved for all the software projects that are being actively maintained.

In terms of total storage required, the annual blockchain growth rate is now down to 17%, which ought to be easily addressed by increasing hard drive density. And of course you can always run a pruned node (though it will still have to download all of the data during the initial sync) that only needs 10 GB or so.

During 2022 the Bitcoin blockchain grew from 383.3 GB to 446 GB - an annual growth rate of 16.4%. pic.twitter.com/bZogajsOAv

— Jameson Lopp (@lopp) January 1, 2023

Bitcoin Economics

As usual, many of Bitcoin's economic metrics were correlated to the exchange rate, which ground downward throughout the entire year.

Bitcoin's 30 & 60 day exchange rate volatility averaged around 3% during 2022. This is 1% lower than 2021 and back to 2020 levels. pic.twitter.com/SYHMJYymBU

— Jameson Lopp (@lopp) December 17, 2022

The median on-chain bitcoin transaction value in 2022 was ~$90, down 50% from 2021 and back to 2020 levels. pic.twitter.com/6HQeYQGGUg

— Jameson Lopp (@lopp) December 27, 2022

.@coinmetrics estimates (by removing likely change outputs) that $8.2T was transferred via the Bitcoin blockchain in 2022, averaging $260,000 per second. pic.twitter.com/LaQgAsu82k

— Jameson Lopp (@lopp) January 1, 2023

From a relative historical standpoint, the overall drawdown in exchange rate was typical for a bear market year.

Bitcoin average DAILY value change during:

— Jameson Lopp (@lopp) January 1, 2023

2010: +0.82%

2011: +0.76%

2012: +0.26%

2013: +1.11%

2014: -0.25%

2015: +0.09%

2016: +0.22%

2017: +0.78%

2018: -0.33%

2019: +0.18%

2020: +0.38%

2021: +0.12%

2022: -0.29%

To calculate the above, use the formula:

Jan 1 exchange rate * (x³⁶⁵)=Dec 31 exchange rate

Some institutional interest in Bitcoin has certainly waned, but most of the corporate treasuries seem to be HODLing.

Bitcoin known to be held on corporate balance sheets at the close of year.

— Jameson Lopp (@lopp) December 23, 2022

2017: 12

2018: 3,479

2019: 4,411

2020: 282,743

2021: 634,451

2022: 572,317

As the exchange rate dropped in 2022, the number of bitcoin addresses storing certain amounts increased. We're approaching 1,000,000 addresses holding more than 1 BTC. pic.twitter.com/m7oPQK5ysv

— Jameson Lopp (@lopp) December 29, 2022

Bitcoin Trading

ATM growth continues to grow but slowed from an exponential to linear acceleration. This makes sense, as last year I questioned whether ATM usage is following suit given that on-chain metrics don't indicate the same level of retail usage.

The number of deployed Bitcoin ATMs increased by 13% during 2022 to 39,000. pic.twitter.com/9Wd841yLXv

— Jameson Lopp (@lopp) December 20, 2022

Crypto exchange spot trading volume halved from 2021 to 2022 but remains multiples higher than in years prior. pic.twitter.com/66HI3Q8nt0

— Jameson Lopp (@lopp) December 22, 2022

While it was a terrible year for users of centralized custodians, it was a great year for proponents of self custody!

Bitcoin balances on exchanges (estimated via on-chain heuristics) dropped 20% from 2,821,054 to 2,244,941 during 2022 according to @glassnode. pic.twitter.com/zjePlecJiy

— Jameson Lopp (@lopp) December 22, 2022

The @BitMEX insurance fund grew by 2.5% in 2022. It now holds 0.19% of all BTC. pic.twitter.com/Mxc0QWJtBZ

— Jameson Lopp (@lopp) December 29, 2022

Willy Woo made an excellent point regarding the following chart - while futures interest declined in fiat terms, it's still up in bitcoin denominated terms.

Open interest for bitcoin futures dropped from $11.5B to $7.3B over the course of 2022. pic.twitter.com/fIBVA2D5wU

— Jameson Lopp (@lopp) December 29, 2022

Technical Development

At a protocol level, there was a great deal of work done in 2022. If you want a deep dive into low level developments I recommend reading Bitcoin Optech's year-in-review.

The Bitcoin Core repository continues to maintain its dominance as the most active.

2022 commits & contributors:

— Jameson Lopp (@lopp) December 31, 2022

Bitcoin Core: 2,587 & 143

Core ⚡️: 1,573 & 61

libbitcoin: 1,182 & 3

lnd: 1,140 & 83

Rust ⚡️: 908 & 45

BTCPay: 841 & 44

Rust Bitcoin: 706 & 45

Bitcoin-s: 676 & 9

BDK: 246 & 35

Eclair: 244 & 12

btcd: 165 & 25

BitcoinJS: 111 & 8

NBitcoin: 106 & 16

Source: calculated from the default development git branch of each repo.

git shortlog --after 2022-01-01 --summary --numbered --no-merges

Here you can visualize the year's activity in the Bitcoin Core code repository:

Conclusion

Most people are only familiar with the exchange rate of Bitcoin, if that. But exchange rate is just one of many metrics we can use to observe the evolution of this ecosystem. While any given metric can be gamed or may be taken from sources that aren’t 100% reliable, by using a diversity of metrics and sources we can get a rough idea of the trends in this space.

2022 was a unique cycle of cascading credit crises and outright fraud by major players. The resulting loss of confidence and interest in the space is something we've seen occur several times during previous cycles. Those of us who are dedicated to this system shall continue to BUIDL and add value; we have no control over the market but I expect that sentiment will rebound and we'll see another wave of adoption by the masses who need it most.

“Every day that goes by and Bitcoin hasn’t collapsed due to legal or technical problems, that brings new information to the market. It increases the chances of Bitcoin’s eventual success and justifies a higher price.” - Hal Finney